ARMA-GARCH Modeling, Volatility and Value at Risk (VaR) Forecasting in Python

import yfinance as yf

from yahoofinancials import YahooFinancials

start_date='2010-01-01'

end_date=end='2021-09-01'

sp_data= yf.download('SPY', # List of tickers

start='2010-01-01',

end='2021-09-01',

progress=False)

Box-Jenkins approach applies ARIMA models to find the best fit of a univariate time series model that represent the stochastic process. This method is including a three steps modelling:

- Identification: Based on the Autocorelation Function (ACF) and Partial Autocorrelation Function (PACF) it is possible to determine p, and q order of the ARIMA model. Also, we can use the Akaike Information Criterion (AIC) to identify the ARIMA order.

- Estimation: Estimation of best ARMA(p,q) order.

- Diagnostic checking: The ARMA process is valid when the residuals (ACF and PACF plots) are uncorrelated.

In order to model volatility, we use the Autoregressive Conditional Heteroscedasticity (ARCH) model. ARCH is a statistical model for time series data that describes the variance of the current error term as a function of the previous time periods’ error terms. The next step is to define the second part of the error term decomposition which is the conditional variance. For this purpose, we can use a GARCH(1, 1) models.

# GARCH normal model

garch_norm= arch_model(sp_data['Log_Return'], p = 1, q = 1,

mean = 'constant', vol = 'GARCH', dist = 'normal')

# Fit the model

garch_norm_result = garch_norm.fit(update_freq = 4)

# Get summary

print(garch_norm_result.summary())

# Plot fitted results

garch_norm_result.plot()

plt.show()

Iteration: 4, Func. Count: 37, Neg. LLF: 3636.279334157137

Iteration: 8, Func. Count: 66, Neg. LLF: 3635.6127436210363

Optimization terminated successfully. (Exit mode 0)

Current function value: 3635.6125256467585

Iterations: 10

Function evaluations: 78

Gradient evaluations: 10

Constant Mean - GARCH Model Results

==============================================================================

Dep. Variable: Log_Return R-squared: 0.000

Mean Model: Constant Mean Adj. R-squared: 0.000

Vol Model: GARCH Log-Likelihood: -3635.61

Distribution: Normal AIC: 7279.23

Method: Maximum Likelihood BIC: 7303.16

No. Observations: 2935

Date: Tue, Oct 05 2021 Df Residuals: 2934

Time: 04:46:33 Df Model: 1

Mean Model

==========================================================================

coef std err t P>|t| 95.0% Conf. Int.

--------------------------------------------------------------------------

mu 0.0902 1.318e-02 6.842 7.783e-12 [6.435e-02, 0.116]

Volatility Model

============================================================================

coef std err t P>|t| 95.0% Conf. Int.

----------------------------------------------------------------------------

omega 0.0401 8.108e-03 4.944 7.635e-07 [2.420e-02,5.598e-02]

alpha[1] 0.1957 2.611e-02 7.497 6.538e-14 [ 0.145, 0.247]

beta[1] 0.7709 2.368e-02 32.552 1.954e-232 [ 0.724, 0.817]

============================================================================

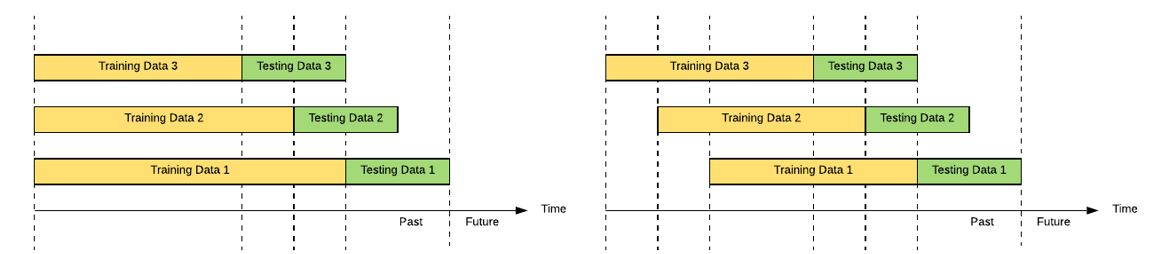

In the Fixed Rolling Window approach, new data are added while old ones are dropped from the sample

In the Expanding Window approach, new data are continuously added to the sample without dropped old data

Example of Evaluation

------------------------------------------------

Rolling Window Forcasting ARCH

Mean Absolute Error (MAE): 0.000113

Mean Absolute Percentage Error (MAPE): inf

Root Mean Square Error (RMSE): 0.000438

------------------------------------------------

Rolling Window Forcasting GARCH

Mean Absolute Error (MAE): 0.00014

Mean Absolute Percentage Error (MAPE): inf

Root Mean Square Error (RMSE): 0.0005

------------------------------------------------

Rolling Window Forcasting EGARCH

Mean Absolute Error (MAE): 0.000147

Mean Absolute Percentage Error (MAPE): inf

Root Mean Square Error (RMSE): 0.000518

We can use the conditional variance given by the GARCH(1,1) model for the estimation of Value at Risk (VaR). For the underlined asset’s distribution properties we can use the specific distribution such as "normal", "t", "skewnormal", "skewt". For this method Value at Risk is expressed as: