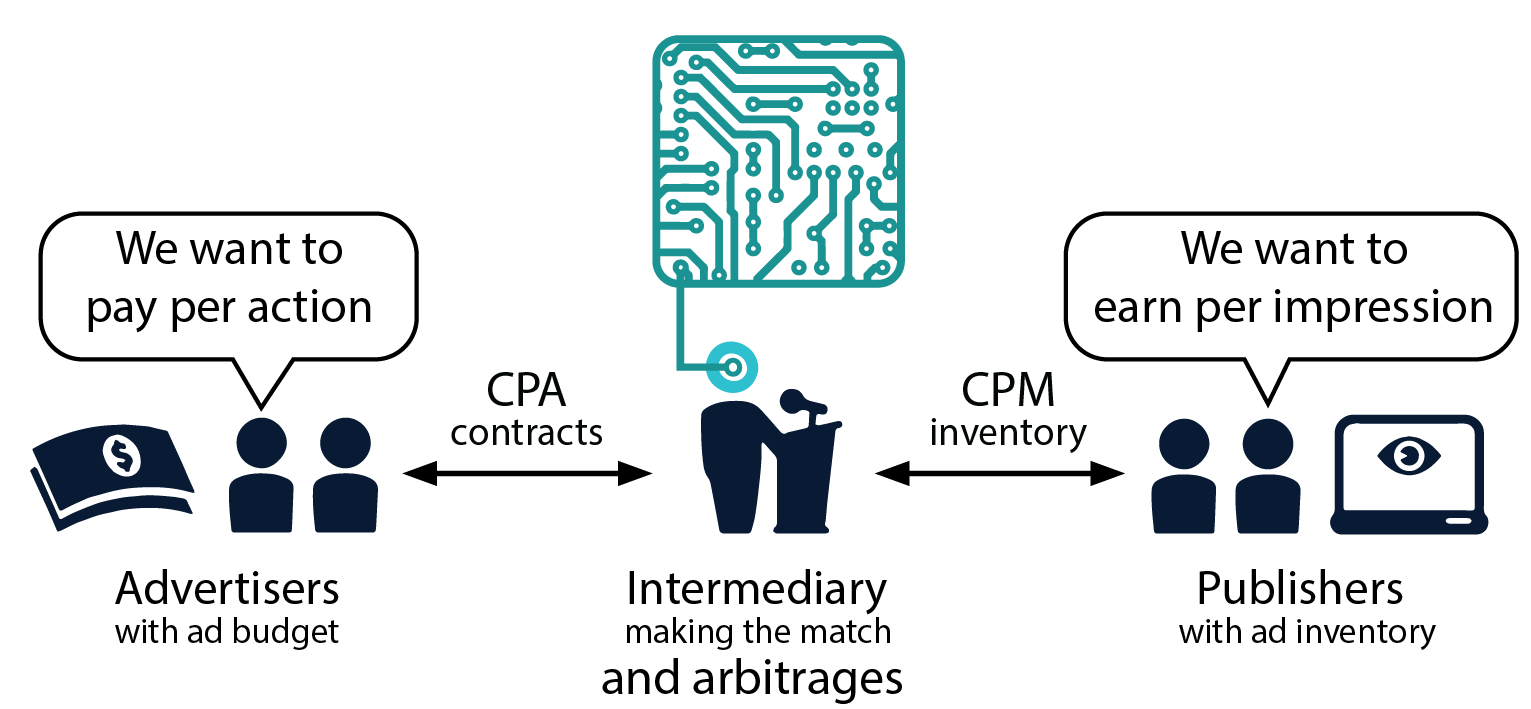

In real-time bidding (RTB) display advertising, advertisers could choose to pay by performance, e.g., pay per action (CPA), pay per sale (CPS), while publishers normally prefer earning by volume, i.e., selling CPM ad inventories. In such case, the intermediaries, e.g., DSPs or ad networks need to take risk to buy CPM ad inventories from publishers and earn CPA payoff from advertisers. Although this is definitely a non-trivial business, there exist statistical arbitrage opportunities for the intermediaries to maximise their net profit with controlled risk.

This is a repository of the experiment code supporting the paper Statistical Arbitrage Mining for Display Advertising in KDD 2015.

For any problems, please report the issues here or contact Weinan Zhang.

After pulling the repository, you could start from checking the single campaign arbitrage demo under the folder of scripts by running:

$ bash single_campaign_arbitrage_demo.sh

After running, you could get the performance table printed in the console like:

prop alpha algo profit cnvs bids imps budget cost rratio para up

16 0.00100 const -2.96 0 80000 740 339072.7 2958.0 0.2 5.0 0.0000

16 0.00100 rand 0.00 0 80000 0 339072.7 0.0 0.2 5.0 0.0000

16 0.00100 truth 44.72 3 80000 601 339072.7 11862.0 0.2 1.0 0.0000

16 0.00100 lin -93.89 13 59404 10843 339072.7 339097.0 0.2 75.0 0.0000

16 0.00100 ortb -131.61 11 55468 12556 339072.7 339091.0 0.2 290.0 0.0000

16 0.00100 sam1 45.77 6 80000 3148 339072.7 67405.0 0.2 25.0 0.0000

16 0.00100 sam1c 59.14 6 80000 1303 339072.7 54032.0 0.2 25.0 8.2433

16 0.00100 sam2 63.92 7 80000 4146 339072.7 68116.0 0.2 7.1 0.0000

16 0.00100 sam2c 60.63 7 80000 4146 339072.7 71408.9 0.2 7.1 0.7942

Note these results are produced from the very small data (the first 300,000 lines for campaign 1458 in iPinYou). Here alpha is a meaningless column for single campaign task.

For the demo of multiple campaign arbitrage with portfolio selection, please run:

$ bash multiple_campaign_arbitrage_demo.sh

and you can get the performance table printed in the console like:

prop alpha algo profit cnvs bids imps budget cost rratio para up

16 0.10000 const -4.26 0 80000 1780 410481.3 4264.0 0.2 5.0 0.0000

16 0.10000 rand -39.98 1 80000 10304 410481.3 106134.0 0.2 29.0 0.0000

16 0.10000 truth 44.72 3 80000 601 410481.3 11862.0 0.2 1.0 0.0000

16 0.10000 lin -184.14 12 40581 10983 410481.3 410491.0 0.2 105.0 0.0000

16 0.10000 ortb -184.16 12 60043 14348 410481.3 410511.0 0.2 290.0 0.0000

16 0.10000 sam1 45.77 6 80000 3148 410481.3 67405.0 0.2 25.0 0.0000

16 0.10000 sam1c 49.06 6 80000 2202 410481.3 64108.8 0.2 25.0 3.9500

16 0.10000 sam2 66.64 7 80000 3905 410481.3 65391.0 0.2 6.5 0.0000

16 0.10000 sam2c 50.21 6 80000 3100 410481.3 62967.4 0.2 6.5 2.6962

16 2.00000 const -3.79 0 80000 1552 410481.3 3787.0 0.2 5.0 0.0000

16 2.00000 rand -0.48 0 80000 310 410481.3 477.0 0.2 5.0 0.0000

16 2.00000 truth 12.26 2 80000 4573 410481.3 72756.0 0.2 1.0 0.0000

16 2.00000 lin -184.14 12 40581 10983 410481.3 410491.0 0.2 105.0 0.0000

16 2.00000 ortb -184.16 12 60043 14348 410481.3 410511.0 0.2 290.0 0.0000

16 2.00000 sam1 45.77 6 80000 3148 410481.3 67405.0 0.2 25.0 0.0000

16 2.00000 sam1c 49.06 6 80000 2202 410481.3 64108.8 0.2 25.0 3.9500

16 2.00000 sam2 45.56 7 80000 4758 410481.3 86471.0 0.2 6.5 0.0000

16 2.00000 sam2c 28.05 6 80000 3937 410481.3 85128.1 0.2 6.5 2.6962

Note these results are based on the very small data sample (the first 300,000 lines for campaign portfolio [1458, 2259, 2261] in iPinYou). Here alpha is the risk-averse parameter in campaign portfolio optimisation. We can observe that different alphas result in different arbitrage performance. More detailed information of the campaign portfolio selection can be accessed in data/multiple.campaign.arbitrage.demo.portfolio.txt.

The code in the current version support the experiment in Sections 4.2 (single campaign) and 4.3 (multiple campaign). The dynamic multiple campaign arbitrage task can be based on re-running the multiple campaign code.

For the large-scale experiment, please first check our GitHub project make-ipinyou-data for pre-processing the iPinYou data. After downloading the dataset, by simplying make all you can generate the standardised data which will be used in the bid optimisation tasks.