Every Bitcoin transaction can be sent with memo text in an OP_RET output. This memo can be used to promote user brand in everyday transactions.

The Endurio Protocol is designed to create an incentive for Bitcoin users to include a small memo into their everyday transactions to promote any brand paid in the market.

- END - The Crypto Token

- Proof of Reference

- Brand Market

- Referral Network

- Advanced Mining

- API

- Compatibility

- Appendix A: Commission Distribution

Endcoin (END) is the crypto token of the Endurio Protocol.

- END's initial supply is ZERO. No token is pre-mined.

- END is freshly minted only by successful mining

endur.io - In the Brand Market:

- END is required to fund user brand campaign

- END is paid by campaigns to the miners mining user brand

- In the Referral Network:

- END is burnt to pay for rent.

- END is paid as a commission for each successful mining.

To mine SomeBrand is to:

- send a Bitcoin transaction with the first OP_RET data begins with "SomeBrand", and wait for a confirmation,

- relay that transaction to the Endurio contract on the Ethereum network.

If there is more than one transaction mining the same band in a block, only one can be claimed. The single successful mining transaction is randomly selected using the block's hash and transaction ID as entropies.

To relay is to provide cryptographic proofs that a mining transaction is confirmed in a valid PoW block. Instead of full relaying, Endurio opts for quasi-relaying that accepts orphaned blocks and blocks that don't belong to any chain.

The mining transaction must be relayed no later than one hour after the target block's timestamp or the reward is lost forever.

The ranking of the mining transaction is randomly calculated using the target block hash and the transaction id itself.

If there is more than one tx mining the same brand in a block, only the one submitted with the lowest

After the relaying time is over, the last relayed transaction can be claimed anytime by the miner. The miner is the Ethereum account that shares the same key pair with the sender address of the mining transaction.

For example, any transactions sent by tb1q49239d5pwn63cqhmnnfgu8z6ndzah7dycgcfql can be claimed by its miner address 0x2222A917A5Fc6A35166346c69402f5677Ce51205 because they belong to the same public key:

a56048b4f7a81655366a09592a1ab9921df35fa8f2d0a6a9a298627e90f8255d

a5b1f3f8887bbab53d13b8fd4a4fe7426012e6a11d35fd1e18377ad3b87e4609

The reward paid for a mining transaction is calculated based on the block's

The $PayRate* of the system brand endur.io is 1.0. The $PayRate* of user brand is set by the campaign owner in the [Brand Market].

At the time of writing, mining endur.io in a Bitcoin transaction earns miner roughly 1.3 END tokens.

For each reward claimed, there's a 1/32 chance that an additional subsidy of the same amount goes to the Development Vault (~3% mining reward).

The Development Vault reward condition is cryptographically randomized as follow:

Multiple brands can be mined in a block, each brand has at most one transaction rewarded for a block. Transactions mining different brands don't compete with each other.

Brand Market is a decentralized market to offer payment to user brand miners via brand campaign.

- The system brand endur.io is paid by the protocol with freshly minted END tokens.

- Mining user brand will not generate any new END token but taking END tokens from the campaign fund.

A brand campaign is created in the Brand Market to offer END token payment for mining a user brand.

A campaign is identified by the brand memo and owner (or payer) so the same memo can be paid by multiple payers via multiple brand campaigns. (See [Design Rationale])

A campaign has:

- memo: the UTF-8 text to mine

- payer: the owner of the campaign

- fund: END tokens amount locked by the owner to pay miners

- payRate: payment rate for each successful mining transaction

- expiration: expiration date

The campaign is deactivated when either:

- the expiration is reached

- all the fund is spent

An expired campaign can be manually deactivated by its owner and all the remaining locked END is refunded.

An unexpired campaign can only be upgraded to either:

- increase the pay rate

- extending the expiration

- add more fund

RefNet is a referral marketing network represented as a forest data structure.

Each node can refer to a parent node. A node with no parent is a root node. The parent node reference can be changed or removed anytime by the children node.

For each mining reward is claimed without development vault subsidy, there's at most 1 additional commission is paid for one of the nodes in the [referral chain] of the miner.

Anyone can join the referral network, but nodes must pay rent to have a chance of receiving commission from descendant nodes mining reward. Rent is paid by burning END tokens via the Referral Network API.

- The higher the rent is, the higher the chance a node will receive commissions.

- The closer the node to the miner in accumulative rent, the higher the chance of receiving commissions.

Decreasing rent can be done anytime and free of charge. Increasing rent requires fee and time restrictions. There are two ways to increase the rent: slow upgrade and quick escalate.

Conditions:

- After 1 week from the last rent upgrade or escalate.

- New rent is no higher than 2 times of old rent.

Note: 302400 is half a week in seconds.

If the upgrade condition is not met, rent can be quickly escalated by paying 3 times the upgrade fee.

The first rent setup for an uninitialized node is always an escalation.

An inactive/expired node will have its rent decayed overtime. This decayed rent will be used as the current rent when the node is reactivated.

If a node with rent

When a

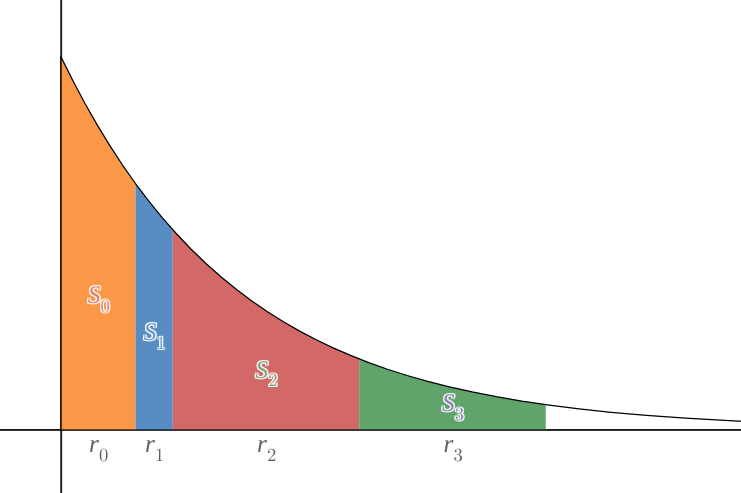

The chance of receiving commission for each node is proportional to their area in the following graph, where the miner is node

The curve is

There's always a chance that no node will receive the commission, which is represented by the blank area after the last node of the referral chain

See [Appendix A] for the commission distribution implementation.

Commission cutback provides the incentive for the miner to join the referral network. The cutback is paid by the commission receiver to the miner when a commission is paid.

Cutback can be paid using native END token, external ERC20 token, or contract logic. The external token interface requires the only method transferFrom(address,address,uint) borrowed from the ERC20 interface. Custom cutback logic can be freely implemented by each sub-network to apply any complex management policies.

The cutback token and rate is configured by each node. The external contract call to custom cutback can be failed or not beneficial for the miner, so the commission can be skipped entirely when the cutback is undesirable.

There are 2 global params for commission distribution, both are currently controlled by the Endurio developer:

-

ComRate: the rate of commission to mining reward, initially set at 0.5. The value range is

$[0;4.294967295]$ . -

RentScale: how much accumulate rent from the miner up the referral chain until the commission chance is halved. The higher the value, the more commission is distributed up the referral chain. Initially set at

$1000$ . Value range is$[0;2^{224})$ .

If quasi-relaying a Bitcoin transaction to Ethereum is costlier than the reward, or the transaction is mined in some alt-chain with very little reward, miners can opt for x-mining to increase the reward by decreasing the winning chance proportionally.

To x-mine a brand, the brand memo (in OP_RET) is appended with one space character (ASCII 0x20), an x, and the decimal string of reward multiplier number m.

OP_RET "endur.io x6"

An x-mining transaction is valid only in a block with

Bounty hunting is to mine a brand and sending some random recent transactors a useful amount of coin.

Bounty outputs are all outputs after the first OP_RET except the last one (reserved for coin change). A transaction can have up to 8 bounty outputs, but only one of the bounty output is randomly sampled for verification.

The index of sampling bounty output in the bounty outputs array is

In Bitcoin, a dust output will be ignored by wallets and recipients because it's not beneficial to spend an amount too small. In bounty hunting transaction, miner makes them an offer they can't refuse.

A useful amount is an amount large enough to pay the fee of the transaction to spend that output. The transaction fee is calculated by the mining transaction itself.

All bounty outputs value must be no less than

Bounty recipient must be the recipient address of the last output (usually the coin change address) of a transaction in a recent block and

A recent block is a block with a timestamp no earlier than 1 hour from the mining block. The reward is calculated by the lower difficulty of the recent block and the mining block.

To make the bounty recipients different for each miner, the recent transaction is eligible for bounty output of a mining transaction must also have this condition fulfilled:

- FirstOutputID is the first input outpoint ID (LE) of the mining transaction

- BountyTxID is the recent transaction ID (LE)

Proof of Reference is cryptographic proofs of a mining transaction being included in a valid PoW block.

ParamSubmit is a mandatory structure with:

- payer (address): the payer/owner of the brand campaign

- header (bytes): the Bitcoin block header byte array

- merkleIndex (uint32): the Merkle index of the mining transaction in the block

- merkleProof (bytes): the Merkle proof of the mining transaction in the block

- version (uint32): 4 bytes of transaction version

- locktime (uint32): 4 bytes of transaction locktime

- vin (bytes): transaction inputs byte array

- vout (bytes): transaction outputs byte array

- inputIndex (uint32): the index of the miner input

- memoLength (uint32): optional memo length for x-mining or prepending user memo after the mining brand

- pubkeyPos (uint32): (optional) position of the 33 bytes compressed pubkey in the miner input byte array

ParamOutpoint is a structure with:

- version, locktime, vin, and vout of the outpoint transaction

- pkhPos (uint32): (optional) position of miner PKH in the outpoint output bytes, including the first 8-bytes value

ParamOutput[] is an array of required outpoints for the transaction inputs.

- In the P2WPKH transaction, only the outpoint of the miner input is required.

- In bounty mining, outpoints for all miner inputs are required in the same order.

- All other cases, the ParamOutput is not required

ParamBounty is an optional structure param with:

- header, merkleIndex, and merkleProof of the sampling bounty recipient transaction block

- version, locktime, vin, and vout of the sampling bounty recipient transaction

Upon successful submit, the Mined event is emitted with useful information for claim params later.

ParamClaim is the structure params with:

- blockHash (bytes32): of the mining transaction

- memoHash (bytes32): brand memo hash

- payer (address): brand campaign payer for user brand campaign

- isPKH (bool): whether the mining transaction contains PKH instead of compressed PK

- skipCommission (bool): option to skip the commission distribution and cutback

- pubX (bytes32): the first 32 of 64 bytes of miner public key

- pubY (uint): the last 32 of 64 bytes of miner public key

- amount (uint): the pre-committed reward amount

- timestamp (uint); the pre-committed timestamp of the mining block

The following params can be extracted directly from the Mined event emitted by the submit transaction: blockHash, memoHash, payer, amount, timestamp, and isPKH. isPKH is true if the first 12 bytes of Submit.pubkey are zeros.

Active, fund, and change the pay rate of a brand campaign.

- memo (bytes): the brand memo

- fund (uint): (optional) amount of END to fund the campaign

- payRate (uint): optional new pay rate (decimals 18)

- duration (uint): optional new duration from the confirmation block time before the campaign is expired

If the brand is uninitialized or expired, both fund and payRate are required, default duration is 2 weeks if zero is passed.

If the brand is active, any or none of the 3 optional params can be provided.

Deactivate the brand and withdraw any remaining funds.

Set an address as the parent node.

Query the node details of and address.

Update the node settings:

- fund (int): optional fund to deposit or withdraw,

- newRent (uint): optional new rent value

- escalate (bool): a consent flag for rent escalation

Passing negative fund value to withdraw from the node balance. Over withdrawing will not be reverted, but empty the remaining balance instead.

If the node is uninitialized, both fund and newRent are mandatory.

The node balance is always divisible by active rent, so some of the balance will be lost due to the rounding on each call to update. Pre-calculation can help minimize the value lost.

Set the cutback option for this node:

- token (address): ERC20 token address to use for cutback, 0x0 to use the native END token for cutback

- rate (uint): cutback rate

- decimals (uint): decimals of cutback rate in case of non-native token

Native END cutback:

- token must be 0x0

- decimals is ignored, fixed with 9

- rate value range is

$[0;10^9]$ $CutbackRate = \dfrac{rate}{10^9}$

Custom token cutback:

- token must not be 0x0

- decimals value range is

$[0; 255]$ - rate value range is

$[0; 2^{88})$ $CutbackRate = \dfrac{rate}{10^{decimals}}$

The END token is an ERC20, so it's valid to set a custom token cutback using the END token address.

The Proof of Reference is originally designed for Bitcoin as the target mining protocol and optimized to be relayed to Ethereum EVM as the host smart-contract platform. It could work with other protocols of the same family, and more target protocols will be supported in the future.