Apple was founded in 1976 by Steve Jobs, Steve Wozniak, and Ronald Wayne to develop and sell Wozniak's Apple I personal computer.

It was incorporated by Jobs and Wozniak as Apple Computer, Inc. in 1977, and sales of its computers, among them the Apple II, grew quickly.

It went public in 1980, to instant financial success.

in 2013 service was announced at Apple's iPhone 6 event on September 9, 2014.

At its announcement, Apple CEO Tim Cook described the magnetic stripe card payment process as broken for its reliance on plastic cards'

"outdated and vulnerable magnetic interface", "exposed numbers", and insecure "security codes".

The iOS 8.1 software update accompanying the service's launch activated Apple Pay on compatible devices.

The company announced an API for app developers to build Apple Pay checkout into their apps

Apple pay is one of the leading mobile

payments and digital wallet services.

It allows users to make

payments in person, in iOS apps, and on the web.

Initially released on October 20, 2014

It is supported on the iPhone, Apple Watch, iPad, and Mac.

It is not available on any client device that is not made and sold by Apple.

originally developed in 2013 in collaboration with visa, America express and JPMorgan

The main competitors are:

- google pay

- samsung pay

- payPayPal.

- Stripe Connect.

- Payoneer.

- GoCardless.

- Authorize.net.

- Bolt.

- Paytm Business.

- Skrill.

- venmo

- cashapp

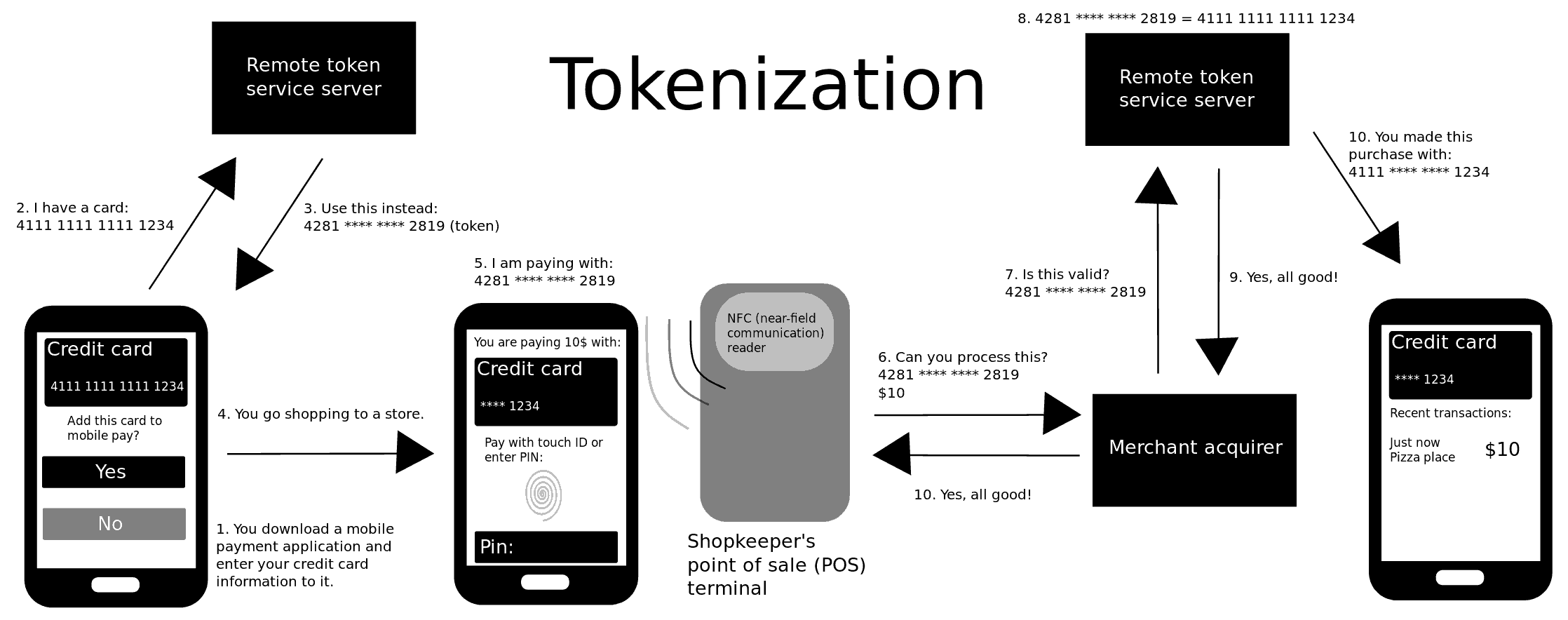

provide users with personal payments using any of apple's devices and provide security on transactions using the EMV Payment Tokenisation Specification as a way

to maintain personal data private from retailers. Tokenization is the process of replacing confidential data with non-confidential data (called "token").

This token data guarantees the same functionality, with the additional characteristic that from the token data itself it is not possible to obtain or infer

the confidential data with which it is related.

The use of advanced technology to provide financial services to consumers and businesses,

to authenticating electronic payments and

the introduction of the Apple payment system,

Apples' digital wallet and apple cash helped to establish apple pay as the largest mobile payment system in the US.

defining apple as a major competitor in the fintech ecosystem

Today, Apple is securing its place as a significant player in the fintech space with Apple Card.

The iPhone offers the Apple’s Wallet app, Apple Pay, and Apple Pay Cash, the Apple credit card is the next logical step.

Apple has partnered with US bank Goldman Sachs to improve the credit card experience by offering a healthier approach to spending.

They’re offering a more transparent list of transactions, organized in an easy to read format, with a more flexible way of

making payments on outstanding balances.

The Closed Ecosystem

Many of Apple’s loyal customers see the company’s tightly controlled software and services as a major strength of the company,

as it allows Apple to control all aspects of the devices it produces.

Overall, however, this puts an additional burden on Apple’s development cycle as software, security, and many other details become an in-house responsibility.

On the other hand Payment

After shoppers have their credit card stored on the iPhone, they only need to keep the phone near an NFC scanner,

use the iPhone’s Touch ID to accept the purchase using their fingerprint,

and the payment is processed within a few seconds.

The approach is easier than the conventional swiping procedure for credit cards,

which normally involves: swiping a card and then choosing debit or credit, providing a different id,

and affixing a signature.

- Payment

- Convenient

- Secure

- No Internet Required

- No Extra Fees

- Privacy

- Low Risk

- Software Failure

- Stability

- Acceptance and Pop-up Texts

- Adoption

- High Fees

- No Online Shopping Support

Mobile wallets are catching up with cash, even in the US.

In 2020, 10% of spending at points of sale (cash tills) made use of a digital or mobile wallet such as Apple Pay.

In comparison, 11.9% of such transactions took place in cash, so the use of contactless mobile payments is clearly catching up.

(In Canada, cash was used for just 5.4% of transactions.)

These are global trends. Worldwide use of cash has dropped 42% since 2019.

Cash will soon be the least used traditional payment method, the report said.

By 2025, Apple Pay will account for 10% of global card transactions, according to research firm Bernstein as reported by Quartz on Tuesday.

The mobile payment feature currently accounts for about 5% of credit card transactions, according to the report.