We imported the data for the project directly from yahoo using yfinance libraries

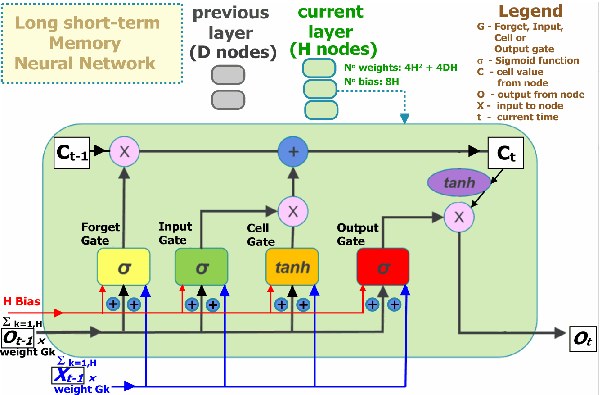

A stock market price predictor running on Recurrent Neural Network (RNN) Long Short-Term Memory (LSTM) is a model that predicts future stock prices based on historical data. The purpose of this model is to identify trends and patterns in stock prices, which can then be used to make informed investment decisions. The RNN LSTM model takes in time series data as input, such as the daily opening and closing prices of a stock over a period of time.

The RNN LSTM architecture is particularly useful in this scenario because it is designed to handle sequential data with variable lengths. The LSTM layer in the model is able to capture long-term dependencies in the data, allowing it to make predictions that take into account not only recent price movements, but also trends over a longer period of time. The model is trained using supervised learning, where the objective is to minimize the prediction error between the actual stock prices and the predicted stock prices.

In summary, a stock market price predictor running on RNN LSTM is a powerful tool for making informed investment decisions. The RNN LSTM architecture is well-suited for time series data, and the ability to capture long-term dependencies allows the model to make more accurate predictions. The model can be trained on large datasets to produce a highly effective stock market price predictor.

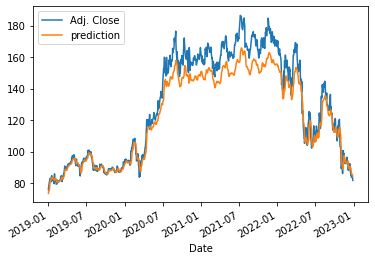

Results Obtained Finally: