-

Notifications

You must be signed in to change notification settings - Fork 72

New issue

Have a question about this project? Sign up for a free GitHub account to open an issue and contact its maintainers and the community.

By clicking “Sign up for GitHub”, you agree to our terms of service and privacy statement. We’ll occasionally send you account related emails.

Already on GitHub? Sign in to your account

ACH Debit #2

Comments

|

See also #3 |

|

+1 |

|

Am I wrong in thinking that this would be something along the lines of 25¢ pay-in transactions? That would be huge. Credit card fees are painful. |

|

@whit537 haven't finalized the pricing yet, but 25¢ to 50¢ sounds like the right ballpark |

|

from @femgineer

Can you clarify what you mean by "refund"? Are you talking about refunding a card transaction or a seller initiated refund, which would require debiting the seller's bank account.

In September. ACH debits is something we have to do, but we need to prioritize against other highly requested changes that are blocking some customers from going live altogether. The more people that comment here and comment on #3, the faster we can move. |

|

+1 for Pessimistic. ACH debits are a requested priority and a September launch would be great. In my situation most buyers prefer to be debited via ACH because the large transactions can't fit on their card. |

|

@whit537 Unlike @jjhurlock's use case, you'd want to debit a buyer's bank account for a relatively small amount (~$10):

|

|

+1 I love where this is going :). |

|

@matin So I get the concept of a large transaction not fitting on the card, but would a seller also have the option to use ACH in the event they do not want to pay the large fee associated with the large transaction? I'm guessing that is something that BizeeBee would to have to offer right? |

|

@matin Also I meant a seller initiated refund, because those are the only types of refunds we would be dealing with on BizeeBee. |

Yes.

Dunno, need to think about that more. The pessimistic flow means ~four days before money is available to gift back out, right? |

|

@femgineer you could use it at any time |

@whit537 not certain. I contacted a few banks yesterday to see the level of service they could provide. Not all banks are equal. I'll post an update here when I have more info on getting the time down, which is a huge component of the experience. |

|

Holy moly, this would be extremely valuable to us at ZeroCater - very excited to follow this. |

|

@whit357 and for people looking to ACH strictly to avoid processing fees. Anecdotally, we've seen lots of people be fairly hesitant about having to provide bank info. Many actually prefer check even with the longer delay and greater inconvenience required to actually cash the check. Additionally there have been studies and speculation positing that credit cards make consumers more likely to spend. I'm not saying ACH in is bad and I agree that card fees suck, but the above evidence makes me skeptical that ACH payment would be a very good solution for low value transactions, whimsy purchases, or marketplaces with short-term customer-marketplace relationships. |

|

@timnguyen Regarding ACH payments for large transactions that can't fit on a single card. Could a user who is hesitant to provide their banking info have the ability to pay simultaneously with two cards? I know Apple.com allows this feature at checkout. |

|

@jjhurlock I don't know about @timnguyen, but in my experience at least, payers don't always have two cards. The usual answer is to split the transaction into several charges over several days. ACH debit would be welcome to replace that awkward practice. |

|

@spenczar I absolutely agree that ACH debits is hands down the better solution for large transactions. That's where both card limits and card fees become very very significant issues. All I'm saying is that for low value general e-commerce transactions ACH for payment is lacking/needs lots of work. I forgot to mention earlier though, I think the major use case for splitting across cards is with prepaid/giftcards. @jjhurlock Currently marketplaces can already create multiple debits with different payments instruments for the same user through balanced. The caveat is that I'm not sure what is the best way to arrange the UX for the form on the marketplace's end. |

|

We vote for both ACH for customer transactions and for merchant refunds @venuebook. |

|

@spenczar @khussein @KRecht @jjhurlock @whit537 What do you expect the average size of ACH debits for you to be? You can send this number to me directly: support@balancedpayments.com |

|

Big upvote here! Crucial for handling refunds and chargebacks because merchants want their money quickly, but that means they have to get it back in for those scenarios. Receiving buyer money via ACH is also a positive. |

|

What would be the limit on ACH Debits? |

|

@rmanisha there won't be one in the API, but the customer's bank may impose one for that particular customer. |

|

Defined milestones and timeline at https://github.com/balanced/balanced-api/issues/milestones |

|

I'm pretty late to this conversion. I apologize if my below questions are already answered: ACH Credits: Do you expect to impose a limit on the number of transactions per day? Is there a limit on any particular transaction size? Do you expect to impose reserves? ACH Credit Batching: How often and when can we batch transactions to our merchants? Will you follow strict times when you initiate instructions? ACH Return Error/Corrections: How will you handle errors and corrections? Will you provide a smart error and return responses (e.g., frozen account, account closed, insufficient funds, invalid account number, invalid routing number). In our experience, the error responses are very helpful for risk management. Also, if a credit fails, will you automatically retry during the next ACH cycle? Some users input incorrect bank information (invalid account/routing number) and we would like to know so we can tell the user why they credit failed. |

|

@matin a cap would be a very welcome addition for us since we've had a few $25k debits and currently run larger payments outside of BP due to cost. |

|

@matin FWIW, a $20 cap on ACH debit would definitely get us to switch our transactions to balanced. We're mostly in the $20-50k range per transaction. |

|

again, just to re-iterate what @matin said, email support@balancedpayments.com get in the beta for ACH debits. |

|

I have done a great deal of research into companies who only provide ACH transactions via their own API's. I have to reinstate that charging 1% is crazy high. On average I was quoted $00.25 that is twenty five cents total, not $00.30 + 1%, just $00.25. $00.25 is the top price and it was lowered with increased usage. Balanced might have a good API but it is not worth using it when comparing the costs involved to other companies offering the same services. |

|

I agree. 1% is very high based on my research. I understand that you guys have to eat, but it just doesn't seem competitive. I've been getting quotes for $0.25 per transaction. Of course, if the business doesn't do any significant volume, then the nice Balanced APIs/speed of integration might make it a worthwhile tradeoff. But your clients are just going to migrate to other solutions as their processing volume climbs. Balanced's competitors' APIs aren't that obtuse! |

|

I'm fine with the 1% fee, as our margins are over 20%. However, we can't use it because of the account verification piece (where On Thu, Aug 8, 2013 at 10:43 AM, erikcw notifications@github.com wrote:

|

|

There is never a reason to leave money on the table. A $500 ACH transaction equals a $5 transaction fee. So for example say you have 5,000 customers paying $500 or more(since there is a $5 cap), that would be a balanced payments fee of $25,000 fee VS a fee of $1,250 with other ACH processors who charge only .25 a quarter per transaction. That is a huge difference of over $23,750 you would loose. |

|

Yaha @jkwade I know it is still a rip off compared to other ACH providers as you will see in my example above. |

|

@bbry The original goal was to provide something that is price competitive by starting at $1 per transaction. We realized that the business case didn't make sense in compared to other priorities like international, foreign currency support, etc. More info in my previous comment: #2 (comment) We revisited offering ACH debits when several customers requested that we reconsider if they were willing to pay more. After enough customers encouraged us, we moved forward. We've had the goal to continually reduce the pricing. Adding a $5 cap was the first step. The plan is to reduce the cap in increments as it makes sense. |

|

I just want to jump in to state that I and my business are very happy with the ACH pricing schedule. There is an obvious selection bias to only get negative comments on a post like this so I want to say thanks for making this happen and this is a huge value add for us. For us, we're not trying to build the cheapest product, we're building the best product and often times that means you need to pay a higher monetary costs to build a system that has other major advantages. If we were looking for cheap we would have opened our own merchant account and been processing our own payments. Likewise with ACH, they are plenty of cheap providers. A lot of this boils down to your business model and market. If you're using ACH for traditional use cases and going against existing providers your are already in a losing margins battle. But if you are using ACH in a novel manner than the $5 fee may actually be incredibly competitive. |

|

That is very encouraging to hear that you are working on lowering your pricing further. Keep up the good work. |

|

Can you please update the documentation on balancedpayments.com? https://docs.balancedpayments.com/current/api.html#debits says:

The "info on ACH debits" links to this github issue. Furthermore, this link https://docs.balancedpayments.com/current/api.html#bank-account-verifications says:

As I understand things, ACH debits is out of beta. |

|

Thanks, @satiani. This should now be fixed. |

|

Came here from https://www.balancedpayments.com/help#q127 seems like that q&a needs to be updated? |

|

Why is this ticket still open? Balanced has offered ACH debits for months now, right? |

|

It'll get closed soon, don't worry.— On Tue, Jan 7, 2014 at 11:20 PM, Chad Whitacre notifications@github.com

|

|

I am still waiting for ACH debits to cost as much as other ACH processors at apx $.20 a debit or credit. |

|

Same here, my site is for landlords accepting rent payments from tenants, however rent payments are always going to hit the $5 fee limit, which isn't competitive with other services the tenant could use for sending the rent. I love the Balanced API so I'm OK with the fees being a bit higher than other services like Dwolla (which has a terrible UX), but $5 is way too much. We're talking ACH here, not credit cards, so we would expect cents rather than dollars for the fee. Then I can add a little more to the fee for myself and have a viable business model for my site! |

|

@jtoth55 curious what the url to your landlord site it also I agree @jtoth55 if dwolla can charge $.25 per a transaction then there is no reason that balanced can not follow, because no landlord is going to pay $5 when they currently pay zero when cashing a check. Or any other business that deals in high dollar amounts. |

|

@bbry just curious who you've found that charges $0.20 per ACH transaction. |

|

@robertdoneill some ACH processors in no particular order are |

|

@bbry thanks for the help! I totally agree. Especially since (in my case where there are just b2b transactions) the "risk" they are pricing for doesn't even apply. Its really a shame, the service is really great otherwise. |

|

We support ACH debits. |

Balanced only allows for pulling money in from credit cards. ACH debits enable the following use cases:

UPDATE

ACH Debits are now supported, visit https://docs.balancedpayments.com/current/?language=bash#debiting-bank-accounts for more information

Email us at support@balancedpayments.com to get in the beta!

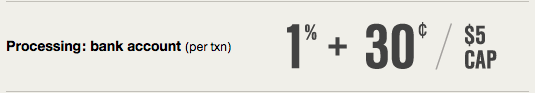

Pricing

The text was updated successfully, but these errors were encountered: