Eternal Trusts is building the first trustee protocol for hybrid intelligence-based autonomous execution of long-term purposes. Eternal Trusts will be setting up all necessary infrastructure to enable fiduciary companies, multi family offices, trustees, and experts from different fields to join the ecosystem and create their own dApps, based on a powerful toolkit that will be provided for them, catered to executing important objectives of people for hundreds of years to come.

The technical paper will describe the implementation details of the decentralized application “EternalTrusts-dApp” as well as the protocol for creating distributed crypto trusts “EternalTrusts-Protocol”, and the differences between them.

The mechanics of trust funds are quite straightforward: in the traditional financial world, trusts are usually employed by those who accumulated wealth over the course of their lifetime to transfer that wealth under control of another trusted party (a trustee) that acts for the benefit of the third party (the beneficiary), or to achieve a specific purpose, e.g. charity. Most trusts are irrevocable, which means that their terms cannot be amended or modified until their purpose has been fulfilled.

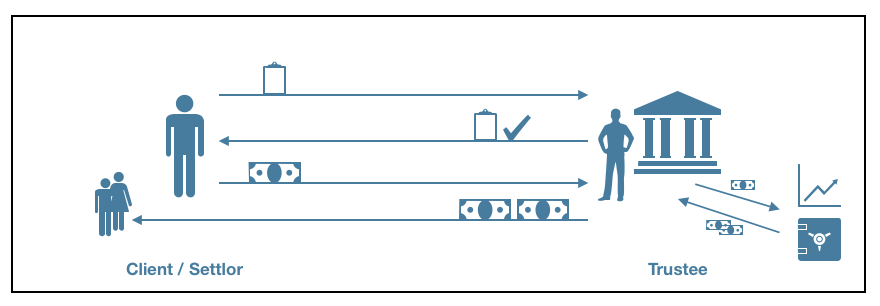

Demonstration of how a purpose irrevocable trust operates

Generally, the process of establishing a trust consists of four steps. A client (a trust’s settlor) specifies a trust purpose which will determine how, when and for what goal the assets will be spent. For instance, such purpose can include covering the costs of education for the settlors’ children when they reach a certain age, at a university selected at the discretion of the trustee. The trustee documents the client’s wishes in relation to the trust assets, and the client transfers the right of asset ownership to the trustee. The trust company usually takes care of the asset management and seeks to grow the wealth in accordance with a certain financial strategy and the wishes of the trust settlor. When the conditions laid down in the trust deed are met, the assets are spent on achieving the trust purpose.

Trusts have operated in the same way for a very long time but as capital redistribution and inheritance needs of people grow and as financial technology advances at rates unprecedented in the history, a growing number of individuals are now thinking well beyond their own life times when it comes to the future management of their wealth. Here’s where the decentralized trusts of ET become valuable and necessary.

Unlike classical trusts, the trustee in Eternal Trusts is represented by a system of smart contracts and a network of oracles — a group of individuals acting anonymously in the interests of the whole platform reputation and being rewarded for the right actions. In terms of asset management, decentralized trusts can store clients’ assets at smart contract addresses, not only in the cryptocurrency form or in the form of EOS / ETH tokens, but also in the form of tokenized traditional assets and funds. Automatic trading between various tokenized assets is possible through the mechanism of cross-chain swaps and decentralized exchanges (DEXes).

Demonstration of how a decentralized trust might work

Holding assets in cryptocurrencies remains quite risky given that the crypto market has been extremely volatile. However, in recent years the trend of digitizing the traditional market assets has become more and more popular: e.g., the tokenization of national currencies, raw materials and precious metals, portfolios, stocks, and indices. At the moment, the most prominent projects that employ tokenization technology are TrueUSD, Tether, Basis.io, ColoredCoin, polymath.network, and Called Havven. Many analysts are expecting a large growth of tokenization projects in the nearest future, and the influx of big capital associated with it into the crypto world is deemed to stabilize cryptocurrencies and make the market less volatile.

The step towards creating the full-scale protocol has been perhaps the most crucial milestone that can increase the magnitude of the project and its impact on the whole blockchain ecosystem. On one hand, the decentralized application of Eternal Trusts (ET-dApp) will consist of an integrated and stable network of DAO directors, with an initial network of oracles and providers preselected by the founders that will be working with a single customer base.

On the other hand, the open source protocol in development (ET-Protocol) will allow for the creation of new ET-dApps on its basis using the ET token. Any company interested in integrating such mechanism of the decentralized trust into its business processes can do this by spawning a network of DAO directors and a network of oracles and contractors, setting up hosting and executive logic in private nodes and off-chain networks.

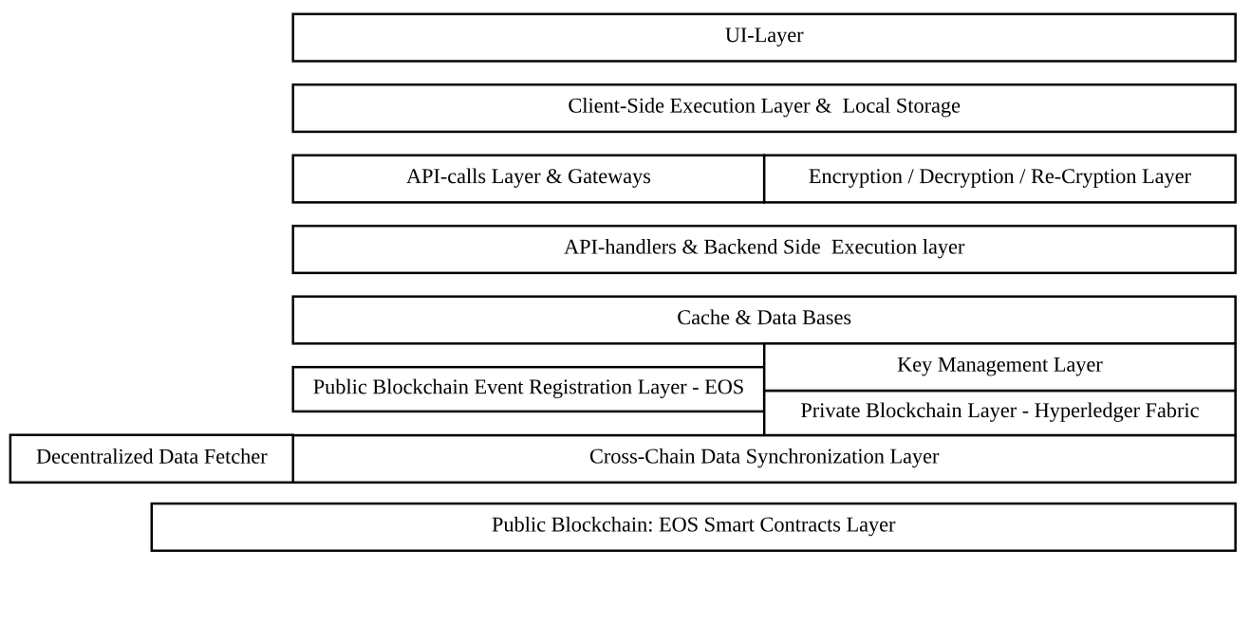

ET-Protocol Architecture

The Eternal Trusts multi-DAO protocol is the first blockchain-based mechanism of establishing crypto trusts — organizations that have fiduciary duties to manage and spend assets on behalf of the clients. These organizations are essentially private/anonymous co-ops comprised of multiple participants with different roles and aimed at spending assets for specific purposes in a transparent and autonomous way.

In order to integrate our protocol for safe and secure distribution of crypto assets and start using it immediately to achieve clients’ purposes, a business owner, trustee, or a family office should establish a decentralized autonomous organization with a network of DAO directors and set up the initial set of DAO rules through voting. These rules, including all fees and parameters, can be modified later through similar voting procedures.

After the initial steps, the DAO directors should gather and choose other participants of the protocol and assign roles. They need to form their own network of oracles (experts, arbiters, and assistants) or choose an already established one with a good track record, set up servers to store and process private data (sidechain nodes) and start attracting clients that want to fulfill their own fiduciary objectives.

Potential clients interested in executing their long-term purposes can begin their communication via the Eternal Trusts application or directly via the front office of the DAO, and formulate objectives to be autonomously fulfilled later.

After formulating the purpose that needs to be fulfilled, the client should choose the most suitable solution among all the proposals and assign a Protector from a close trustworthy person (e.g., a family member). The Protector is able to withdraw funds to the initial wallet of the client in a critical situation. When the clients arrive on the platform, they have to transfer their crypto assets onto a smart contract, initially with an ability to return those assets if needed through a special type of transaction. However, in the end the clients must revoke their rights to the assets and entrust them to the DAO in order for it to begin managing their assets and fulfilling their purposes. If the service is not good enough, the client or the Protector can initiate the process of removing the DAO and replacing it with a more suitable one.

Once a predefined trigger is set off, a series of voting by oracles begins that determines what must be done optimally in the best interests of the client. When the optimal solution is formulated and voted on, the necessary amount of crypto assets is made available using the multisignature protocol by some of the DAO participants and sent to the wallet of the service provider, or a mediator that can receive crypto and send fiat to the provider. The payment is finally confirmed by an Oracle-Arbiter, assigned by the DAO or the client.

This intricate, but easy-to-use system can give fiduciary companies, multi family offices, trustees, and other businesses in need of the fiduciary process an unprecedented flexibility, optimization, and security.

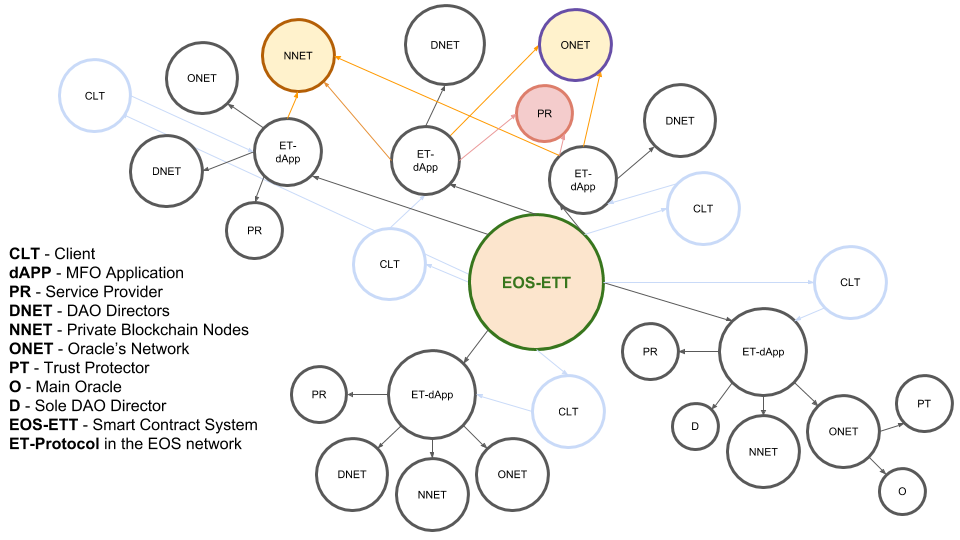

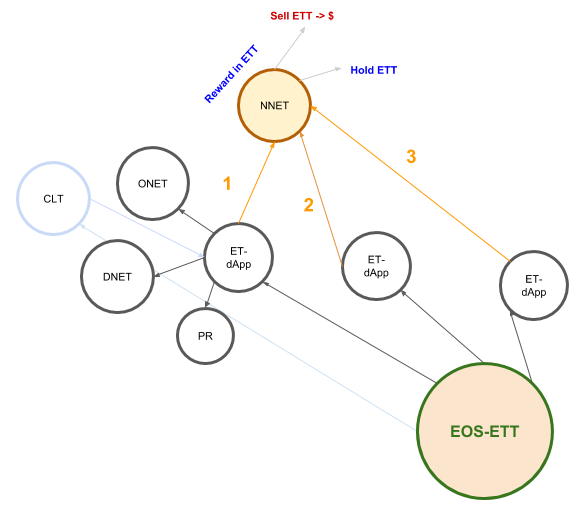

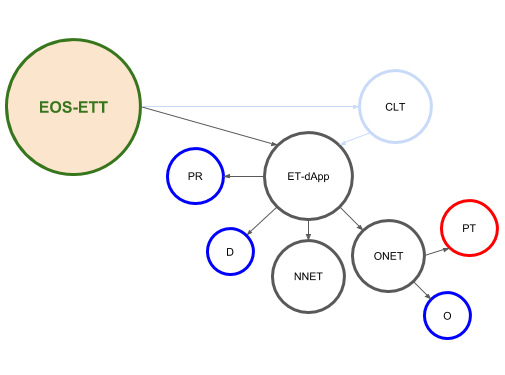

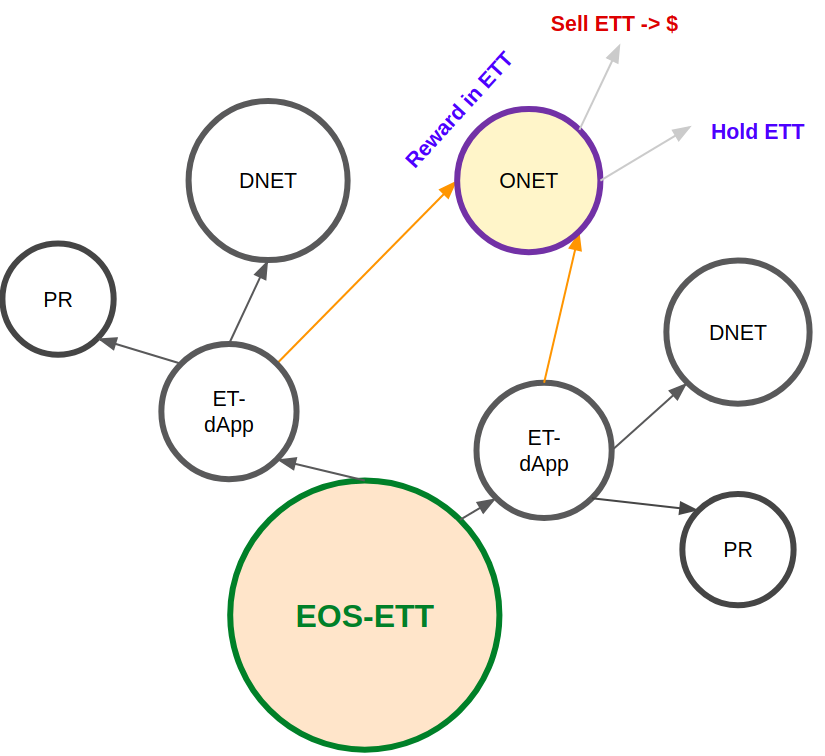

Main potential ways of integrating the protocol are described on the schemes below. Here’s what the abbreviations mean:

CLT — Client

dAPP — Multi Family Office Application

PR — Service Provider

DNET — Network of DAO Directors

NNET — Private Blockchain Nodes

ONET — Network of Oracles

PT — Trust Protector

O — Main Oracle

D — Sole DAO Director

EOS-ETT — Smart Contract System “ET-Protocol” in the EOS network

The widespread adoption of ET Protocol will result in a large fiduciary ecosystem with multiple actors competing for the right to manage the clients’ assets and achieve their long-term objectives.

The general scheme of ET-Protocol ecosystem

The default method of integrating ET-Protocol is presented below, where all the details of the system’s function, including the participants and the technical infrastructure, are predetermined, customized and set up by the DAO directors. In this case, a business owner, trustee, or a family office creates a decentralized autonomous organization with its own network of DAO directors and sets up the initial set of DAO rules.

After the initial steps, the DAO directors should select all participants of the protocol and assign their roles. They need to form their own network of oracles (experts, arbiters, and assistants), set up servers to store and process private data and start attracting clients that need to fulfill their fiduciary objectives.

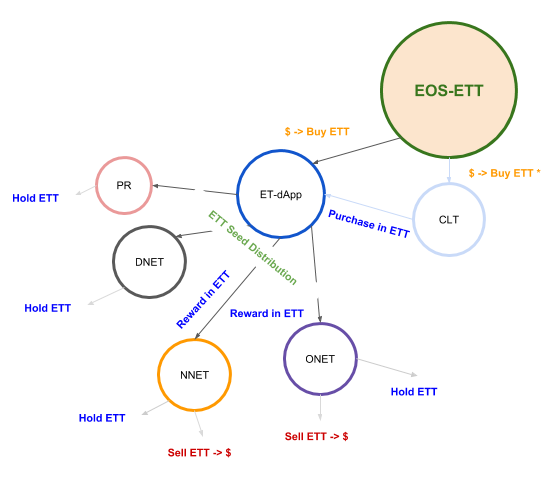

ET-Protocol Regular dApp Structure & ET Token Circulation

In this case, a service provider has to purchase tokens to create and initiate smart contracts and distribute the required token amount to the participants. There is no need for the client to buy tokens because the assets are automatically converted after their transfer onto the smart contract of the ET-dApp. Some participants of the system must hold tokens to continue participating in the process further.

Besides the custom use case with all participants determined and all infrastructure set up by the ET-dApp DAO directors, the ET-Protocol provides several ways to optimize the structure and hierarchy of the fiduciary system, depending on its end goal and available resources. One of the ways to make the whole process less complicated is renting private node networks instead of setting them up from scratch.

ET-Protocol Private Nodes Network

In essence, the creators of an ET-dApp would not need to deploy their own private node Hyperledger-based network with limited access to data/keys and to private information channels between the participants. Instead, they can use ETT Tokens to rent already existing networks that passed security audits.

We think that creating and renting public NNETs for ET-dApps can become a very lucrative business model for providers of computational resources with a good reputation and track record.

It is not necessary for the creators of ET-dApps to gather their own networks of oracle experts. They can employ already established expert networks that specialize in fields related to the client’s purpose.

ET-Protocol Oracles Network — ONET

For institutions, companies, and other groups of experts with a good track record, this is a familiar and attractive way to monetize their knowledge and expertise.

Similarly, it is not necessary for the creators of ET-dApps to establish their own networks of service providers.

ET-Protocol Providers Network

Forming the network of service providers while earning an additional fee from customer’s assets is an appealing model for organizations working with exchanging cryptocurrency and fiat money, as well as any service providers ready to accept cryptocurrencies as a means of payment.

To sum up, when creating and configuring ET-dApps, the protocol can provide advanced customization, sometimes at the expense of decentralization, and a narrow specialization of the service being created.

For example, an ET-dApp creator can assign special roles to some participants of the oracle network, such as the role of a Protector (PT) who will have the authority to veto decisions and withdraw assets from the smart contract according to strictly defined rules, and will serve to protect the clients’s assets from unwarranted spending and to oversee the purpose execution flow.

Also, an ET-dApp creator will be able to specify another type of third parties — oracles-beneficiaries (O), in case of providing trustee services that require asset redistribution. In particular, the Trustee itself can simultaneously be a service provider (PR), the sole director of DAO (D) and the principal beneficiary oracle (O), as shown in the scheme below.

ET-Protocol Customized Case

An example of such use case is that of a traditional trust fund but with the goal of reducing the human factor, providing standardization and automation of business processes. This also leads to the reduction in the service costs and the minimization of risks when working with cryptocurrencies, in comparison with the traditional scheme of handing over keys or cryptowallets from their owners to the trusted party.

The Eternal Trusts Token is a service token needed to execute the Purpose Execution Flow for the dApps built on the ET Protocol. The revenue model for the ET Protocol is based on the expectation of the increase in the ET token demand. The strict rules for token holding specified by the protocol architecture and dApp founders are necessary to ensure there is always a scarcity limiting the supply of tokens in circulation. The expansion of the participant pools and the growth of the number of dApps made with the protocol are also primary factors that influence the growth of the token.

Holding of the token is ensured by several mechanisms:

- The ET Token is a reward token for participants on the platform. Those who are rewarded have to hold a predetermined share of their tokens from each reward to retain their voting/participation rights within the ET ecosystem and participate in the dApp’s purpose execution flows.

- The token is used as an intermediate currency for internal payments (from and to EOS). This can guarantee a token holding lag of few hours to several days.

- The token is needed to initiate redistribution of stake and hold (hold demand is determined by the smart contract) for allowing the token holders to remain active on the platform or receive services, namely:

- The token is necessary to create dApps with the protocol and set up networks of DAO directors, oracles, service providers, and maintain server infrastructure.

- The token is used by clients of dApps to pay for the services of oracles and for the maintenance of private nodes. The token can either be automatically converted from the client’s assets by the smart contract/gained as a gift from an existing token holder, or purchased on exchanges/during the ET token sale.

Another important model that can provide revenue within the protocol ecosystem is technical support, consulting, and deployment of infrastructure for specific clients.

Potential revenue that a fiduciary (or other) business can receive using the protocol is highly dependent on the business model chosen and the market strategy. Although it is not practical to predict potential revenues for the ET protocol users considering a wide variety of business models and commission structures they might use, it is uncomplicated to estimate costs of protocol integration in a basic case.

Let’s give an itemized estimate of the costs of integrating the protocol (costs are given in dollar equivalent of tokens):

- $1000 to build a dApp with the protocol toolkit.

- $100 per each DAO director.

- $25 per each oracle.

- $10 per each node.

- $100 -- holding amount per each provider.

A sample dApp case might consist of:

- 100 customers

- 10 DAO Directors

- 15 oracles

- 11 nodes

- 10 contractors

Which yields:

- $3500 for starting up the whole infrastructure

- $10 000 -- customization

- $5 000 per month -- maintenance and technical support

The minimal cost of all items needed to integrate the protocol into an existing business in need of the collective fiduciary management of client’s assets, is predicted to be at about $10 000 in fiat or tokens to set up the dApp and about $5 000 per month for technical support, consulting, and server maintenance.

To sum up, the cost of out-of-the-box protocol integration into corporate IT systems and business process is negligible. A company integrating the ET protocol receives a ready-made solution that includes exclusive rights to sell their dApp, choose private nodes or networks of oracles for their specific use cases, and the full functionality of the purpose execution flow for an affordable price.

- Completed R&D of the Ethereum ecosystem usability and picking the most optimal blockchain for creating decentralized “trusts”

- Conducted experiments with oracle networks and reputation scoring (together with the developers of Forseti)

- Research and experiments on NEO blockchain and Trinity token swaps to be integrated instead of Ethereum

- Developed the “Purpose Execution Flow” as a framework replicating Discretionary Irrevocable Purpose Trusts

- After a series of architecture reviews from top technical teams and multiple experiments, updated the concept towards building a hybrid blockchain with Hyperledger and EOS

- Implemented the decentralized gate between private and public blockchains

- Developed our positioning into a fiduciary protocol for dApps for trustees & multi family offices

- Completed the smart contracts architecture design of the Protocol and for the dApps built on top of it

- Received first UI/UX of the clients dashboard and the oracle personal cabinets

- Engaged open source community with a series of open technical competitions

- First Dynasty Support algorithm (initially without the token)

- Integrating private Hyperledger nodes

- Deploying experimental smart contracts for the prototype and prototype-token circulation

- Listing of the token prototype on a decentralized exchange and testing tokenomics

- Finalizing, packaging and distributing the codebase for the private nodes and clients’ dApps

- Assisting early adopters in the development of dApps on the Protocol

- Promotion, sales, and marketing among banks and funds. Further organic development of business models on the ET Protocol