Don't pay for a crypto algo-trading service when you can do the same thing for free with CryptoBots! CryptoBots is an open-source Python package with pre-built trading strategies ready to be deployed on your favourite crypto exchanges. It is built on AutoTrader and designed primarily to be used as a command-line tool, making it easy to configure and deploy trading bots on your very own computer.

CryptoBots currently includes the strategies listed below.

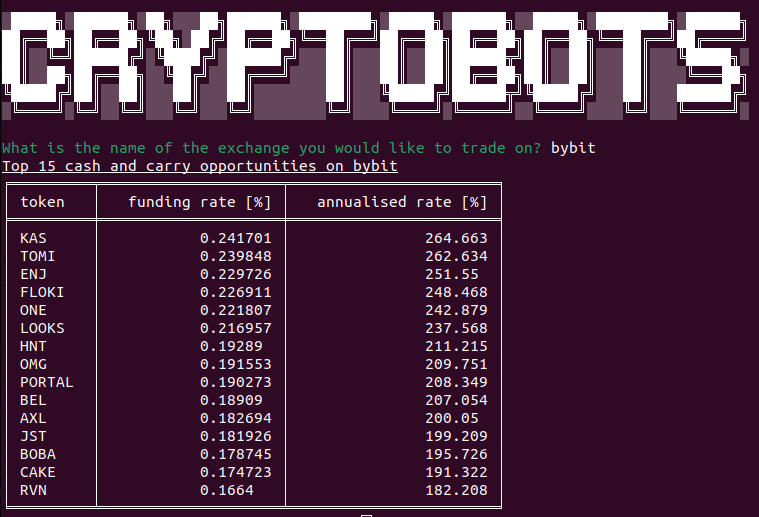

Cash and carry bot

This bot seeks to earn perpetual futures funding rates whilst in a hedged position, by buying a token on the spot market, and shorting the perpetual future of the token. This protects against price volatility, whilst capturing the funding rate paid out by the perpetual futures market.To identify potential tokens to trade with this strategy, use

cryptobots cash-and-carry.

You will see something like this:

From here, you will be asked if you want to deploy a bot to take advantage of these opportunities!

Breakout bot

This bot is perfect for trading trending tokens using a breakout strategy.The strategy works by making an initial trade in the direction of the trend, determined using an exponential moving average. However, if price moves against the open position by a certain amount, the position direction will be reversed. This makes the assumption that a trend is coming up, and price will not remain within the bounds set by the stop loss distance.

If you are feeling extra certain about an impending trend, you can increase the size multilpier, so that losses are recovered quicker.

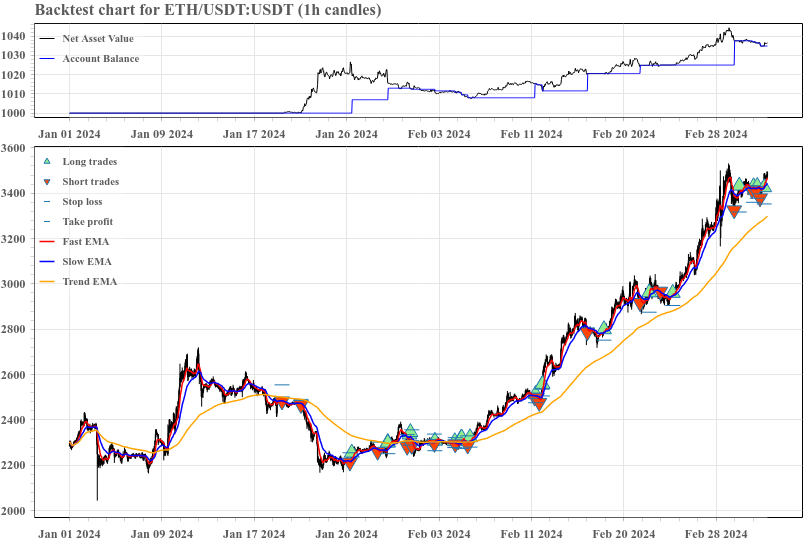

EMA crossover trading bot

This bot will trade trends by using the EMA crossover strategy. Below are some backtest results on ETH.

----------------------------------------------

Trading Results

----------------------------------------------

Start date: Jan 01 2024 01:00:00

End date: Mar 04 2024 00:00:00

Duration: 62 days 23:00:00

Starting balance: $1000.0

Ending balance: $1034.91

Ending NAV: $1036.92

Total return: $34.91 (3.5%)

Maximum drawdown: -1.86%

Total no. trades: 40

No. long trades: 20

No. short trades: 20

Total fees paid: $0.0

Total volume traded: $4021.61

Average daily volume: $64.86

Positions still open: 1

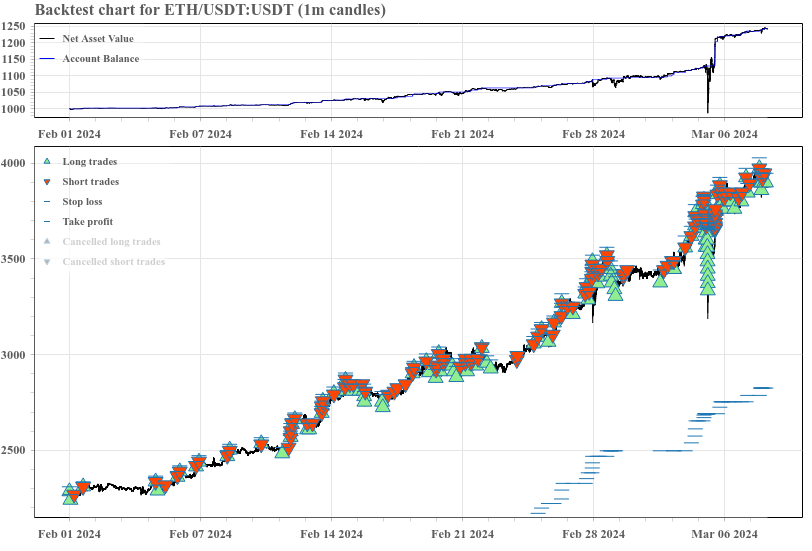

Grid Bot

This bot will buy and/or sell at set grid levels. When you expect market conditions to be choppy and sideways-moving, a long/short grid works best. In this scenario, the bot will buy when price dips, and sell when price rises. When you expect the market to be trending (up or down!), a one-directional grid works best. In this case, the bot will act as a trend-follower with a trailing stop loss at each new grid level. Below is a backtest from running the grid bot in long trend mode on ETH/USDT perpetual from February 1st to March 9th 2024.

----------------------------------------------

Trading Results

----------------------------------------------

Start date: Feb 01 2024 00:01:00

End date: Mar 09 2024 00:00:00

Duration: 36 days 23:59:00

Starting balance: $1000.0

Ending balance: $1243.92

Ending NAV: $1242.28

Total return: $243.92 (24.4%)

Maximum drawdown: -13.12%

Total no. trades: 238

No. long trades: 120

No. short trades: 118

Total fees paid: $0.0

Total volume traded: $34782.46

Average daily volume: $966.18

Range Bound Grid Bot

This is similar to the grid bot above, but it is configured by specifying the upper and lower price bounds of the grid directly. It is also only for neutral grids (long and short trading about a reference price). Since this is a mean reversion strategy, only limit orders are used for trade entries. It is a bit more intuitive to set up, and allows you to specify the maximum position size and total number of grid levels.TWAP Bot

This bot will buy a chunk of tokens every update period until the target position is reached. Useful for splitting up a large position into smaller trades to avoid slippage.The following strategies will be added soon.

EMA mean reversion bot

This bot will use limit orders to trade around a dynamic mean price, capturing market fluctuations on short timeframes.Have a strategy idea you think might make a good addition to CryptoBots? Suggest it using the repository's issues.

CryptoBots has been tested on the following exchanges. It should work on others too, but I am yet to do extensive testing on them. More will be added soon!

| Exchange | Referral code |

|---|---|

| Bybit | 7NDOBW |

CryptoBots can also be used as a convenient tool to deploy your own

AutoTrader bots. To do so, use the

cryptobots configure method to add the path to your project directory. Then, when you

are ready to deploy a bot, specify the project name using the --project argument in

the cryptobots run command.

CryptoBots can be installed from PyPi using pip install:

pip install cryptobots

Once installed, you will have access to the cryptobots command line interface. See the usage

guide below for more.

CryptoBots is primarily a command-line based tool. Once installed, you will be able to use the

cryptobots command line interface from your terminal.

If you type cryptobots, you will see a list of commands available.

Configuration

The first thing you want to do is run cryptobots configure, which will set up your cryptobots

home directory and prompt you to add your exchange API keys. You need to do this before you can

trade.

Available strategies

To see the strategies cryptobots has available, run the cryptobots strategies command. This

will list all available strategies and give you a description of what each one does.

Deploying a strategy

To deploy a strategy, use the cryptobots run command, and follow the prompts.

Stopping a strategy

To stop a strategy, use the cryptobots stop command, and follow the prompts.

Backtesting a strategy

To backtest a strategy, use the cryptobots backtest command, and follow the prompts.

Below are some common questions you might have about Cryptobots. If you have any other questions, feel free to raise an issue.

Why should I use CryptoBots?

CryptoBots has been designed to be as easy to use as possible. If you want to start trading crypto but aren't sure where to start, CryptoBots is for you. If you want to start algotrading, CryptoBots is for you. If you already know how to trade and how to write Python code, CryptoBots is for you - it is easy to add your own strategy and use CryptoBots as a nice deployment framework.Are my API keys safe?

Yes! When you set up CryptoBots and enter your exchange API keys, they get stored on your computer in the `.cryptobots/` folder of your home directory (unless you specify a different location). This is where they stay. Make sure to follow general cyber security practices and you should be fine. Never share your keys online!Do I need to know how to code?

No! The trading strategies have been written for you! Simply deploy them using the command line interface as described above.Where should I run CryptoBots?

You can run CryptoBots on any regular computer - you just need to have Python installed.How much money should I trade with?

That is entirely up to you - start with a small amount you are comfortable with, then you can increase it as you see fit. Where possible, the bots will check to make sure you have enough money in your account before trading, based on the strategy configuration provided.If you like this project, please show your support by using any of my referal links shown above. The exchanges are running promotional programs most of the time, so by using my code, we both benefit. For example, sign up to Bybit using the referral code above, and receive up to 25 USDT for free! See here for more information.

If you really like the project, please conisdering sharing it - the more popular it is, the more time I will invest into adding more strategies.

This software is for educational purposes only. Use it at your own risk. The author assumes no responsibility for your trading results. Do not risk money that you are afraid to lose. There might be bugs in the code - this software does not come with any warranty.