Welcome to the Tesla Stock Price Prediction project! This repository leverages the power of Long Short-Term Memory (LSTM), a sophisticated type of Recurrent Neural Network (RNN), to predict future Tesla stock prices (TSLA) based on historical market data. By using advanced deep learning techniques, this project aims to model and forecast the stock price movement with precision, offering insights into the market's behavior.

- Stock Symbol: TSLA (Tesla, Inc.)

- Model: LSTM (Long Short-Term Memory) – a state-of-the-art approach for time-series forecasting.

- Objective: Predict future stock prices by learning patterns from historical stock data.

- Evaluation Metric: Root Mean Squared Error (RMSE) – to measure the accuracy of predictions.

This project utilizes some of the most powerful Python libraries for data manipulation, machine learning, and visualization:

- NumPy – for numerical computations.

- Pandas – for data processing and manipulation.

- Scikit-learn – for preprocessing and data splitting.

- TensorFlow – for building and training the LSTM model.

- Matplotlib – for plotting and visualizing results.

To replicate this project and experiment with the Tesla stock price prediction, follow the steps below.

First, clone this repository to your local machine:

git clone https://github.com/niladrridas/tesla-lstm-prediction.gitMake sure you have all required libraries installed. Use pip to install the dependencies:

pip install numpy pandas sklearn tensorflow matplotlibOnce dependencies are installed, execute the main prediction script:

python main.pyHere is a detailed breakdown of the project structure:

TSLA.csv: Contains the historical stock data for Tesla, which is used as the input for the LSTM model.main.py: The core Python script that:- Loads the Tesla stock price data from

TSLA.csv. - Preprocesses the data (scaling, reshaping for LSTM input).

- Splits the data into training and testing sets.

- Constructs and compiles the LSTM model.

- Trains the model while monitoring loss and validation accuracy.

- Makes predictions on test data and evaluates the model’s performance.

- Visualizes the training process and the stock price predictions.

- Loads the Tesla stock price data from

- Data Loading: The historical stock data of Tesla is loaded into a pandas DataFrame.

- Data Preprocessing:

- Feature scaling is applied using

MinMaxScalerfromsklearnto normalize the data. - The dataset is split into training (80%) and testing (20%) sets.

- Feature scaling is applied using

- Model Architecture:

- The LSTM model consists of several layers, designed to capture temporal dependencies and learn from past stock price trends.

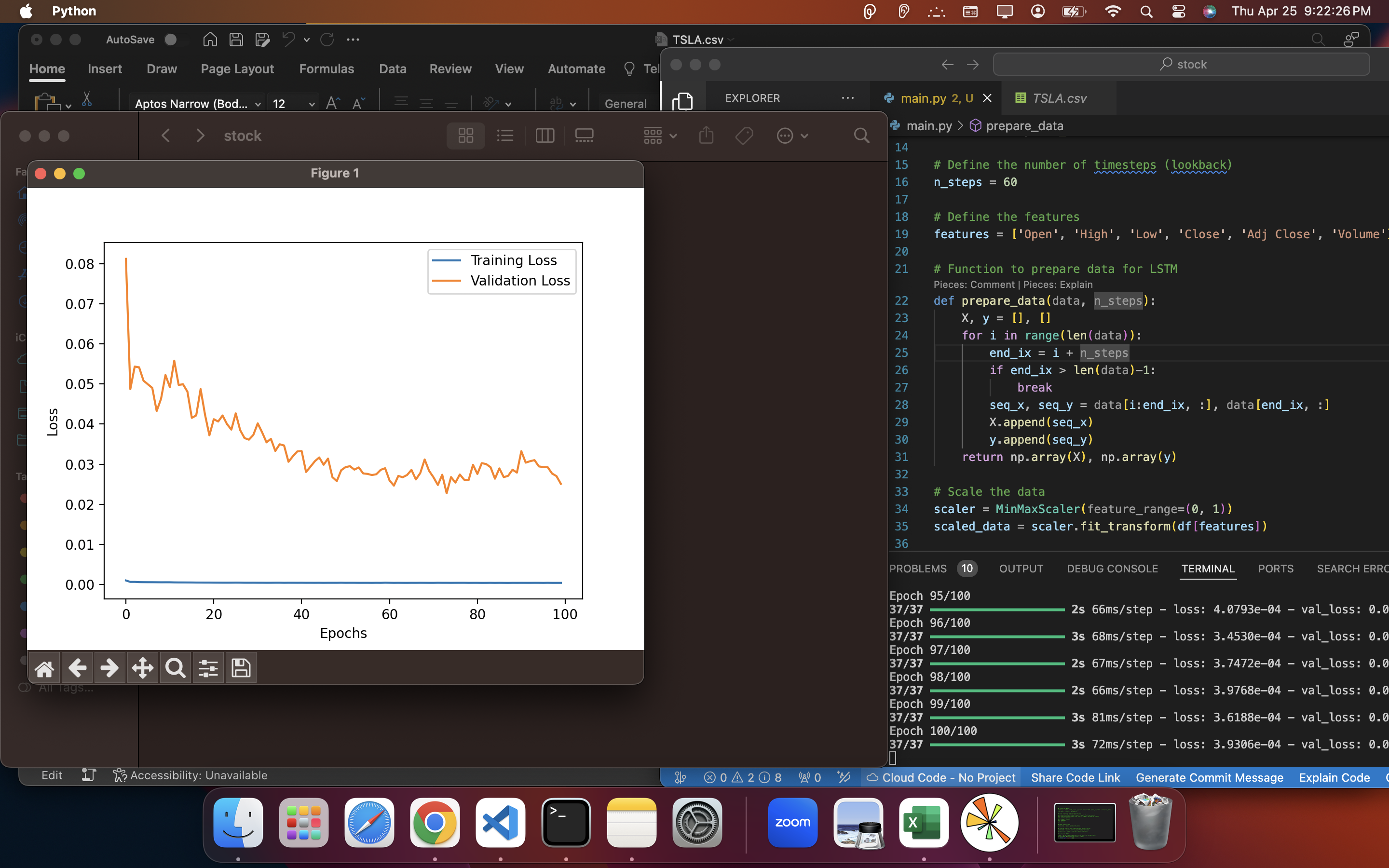

- Training:

- The model is trained on the historical data, with mean squared error (MSE) as the loss function.

- The training process is visualized by plotting the loss over epochs.

- Prediction:

- The trained model makes predictions on the test data.

- The predicted and actual stock prices are compared after inverse scaling.

- Evaluation:

- The RMSE score is computed to quantify the model's prediction accuracy.

- Results are visualized through graphs showing predicted vs. actual stock prices.

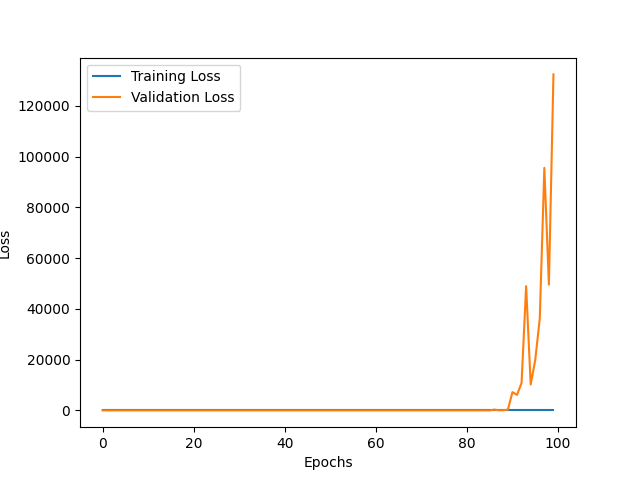

Below is a plot showing how the model's loss decreases over time, indicating learning progress:

This graph illustrates the model’s predictions compared to the actual stock prices, giving a clear view of the model’s accuracy:

While the current model performs well, there are several potential improvements for the future:

- Hyperparameter Tuning: Experiment with different LSTM architectures, optimizers, and learning rates.

- Additional Features: Incorporate additional market indicators (e.g., volume, moving averages) for better context.

- Transfer Learning: Explore transfer learning techniques using pre-trained models.

- Real-time Predictions: Implement real-time stock price predictions by integrating live data APIs.

Feel free to contribute to this project by submitting a pull request, improving the model, or suggesting new ideas!

This project is licensed under the MIT License. See the LICENSE file for more details.

For any questions or collaborations, feel free to reach out:

- Author: Niladri Das

- Email: niladrridas1@gmail.com

- GitHub: Niladri's GitHub

Happy forecasting, and may your predictions be ever in your favor! 🚀