Fraud prevention and traffic filtering service (FlexyGuard) is a dedicated web-service which pre-processes all payment requests. The Guard system analyses payment request snapshot and applies set of filters to return a scoring remark back to Public API.

Every payment request is re-routed to FlexyGuard in the first place

The Guard system assigns a check result and a score to every payment request and sends the result back to the caller. Filtered payment requests could be monitored via Analytics/Reporting interface on a dedicated dashboard.

Appropriate alerting mechanism could be set for scoring aggregated number or payment decline reason or any day-to-day fraud monitoring process requirements in Analytics/Reporting system

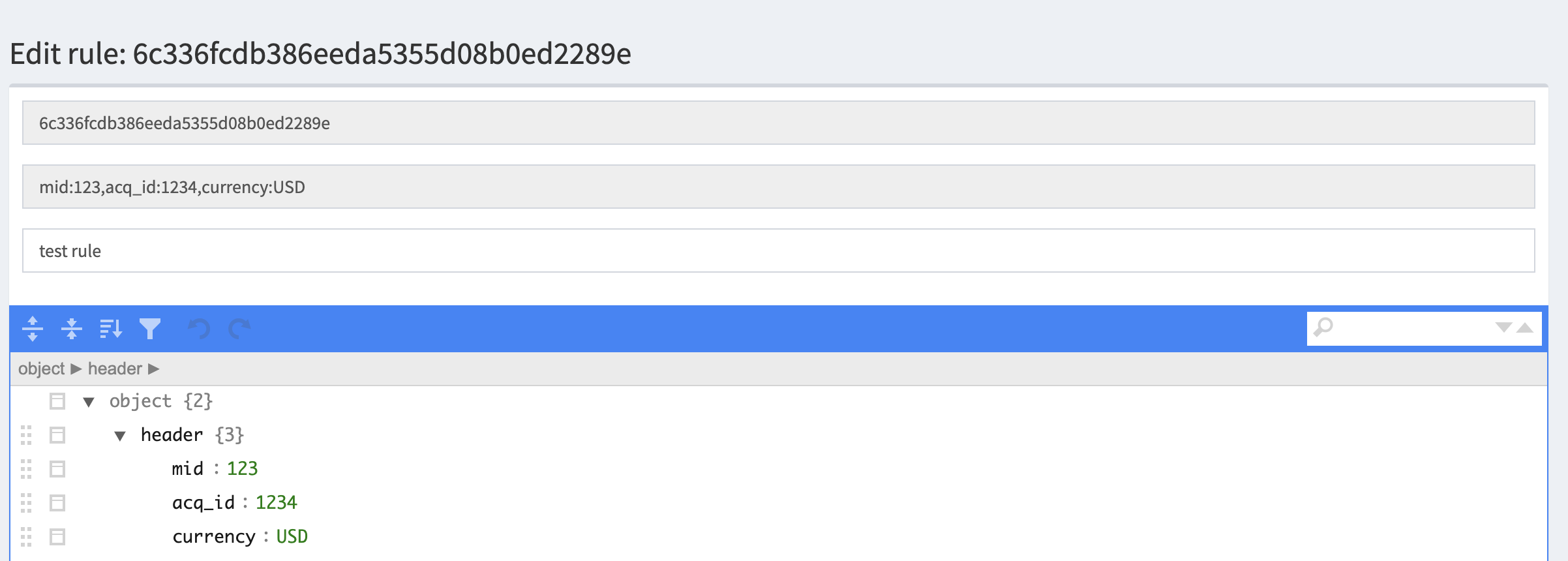

Any filtering rule contains of two parts: a header and a body, where the header containg keys and values from payment request which trigger the rule once all the key/value pairs match the ones from the payment request.

For example:

"header" : {

"mid": "some_merchant_id",

"currency": "USD"

},

"body": {

"amount": {

"value":[1000, 10000]

}

}

//The code above indicates that every time we have payment

//with mid and currency set to "some_merchant_id" and "USD" accordingly

//the following rule body will be applied:

//check if amount parameter value of payment request is between 1 and 100 USD

Default payment parameters are (could be modified in definitions section of FelxyGuard admin console):

data - additional data that could be sent in "extra_return_param" field on public API

amount - tx amount in cents (100 cents = 1 USD)

gateway_amount - amount in cents accepted by the acquirer (usually converted from tx amount, 100 cents = 1 USD)

userid - lead_id field from Payments object (table)

email - payer's email provided on the payment form or via Public API

tid - payment unique token assigned by the system

acq_id - type of gateway whic has been used to facilitate this payment

status - payment status (Pending, Approved, Declined)

ip - referral IP address

currency - currency code (USD, EUR, PLN, CNY, etc)

gateway_currency - currency code accepted by the acquirer (USD, EUR, PLN, CNY, etc)

card - PAN token attribute of Payment object (table)

bin - BIN number attribute of Payment object (Bank identification number, first 6 digits of PAN)

order - an order number assigned by a merchant

type - Payment type (PayIn, Payout)

product - product description assigned by a merchant

company_id - merchant company name

mcc - merchant category code, assigned to a merchant account by the settings services

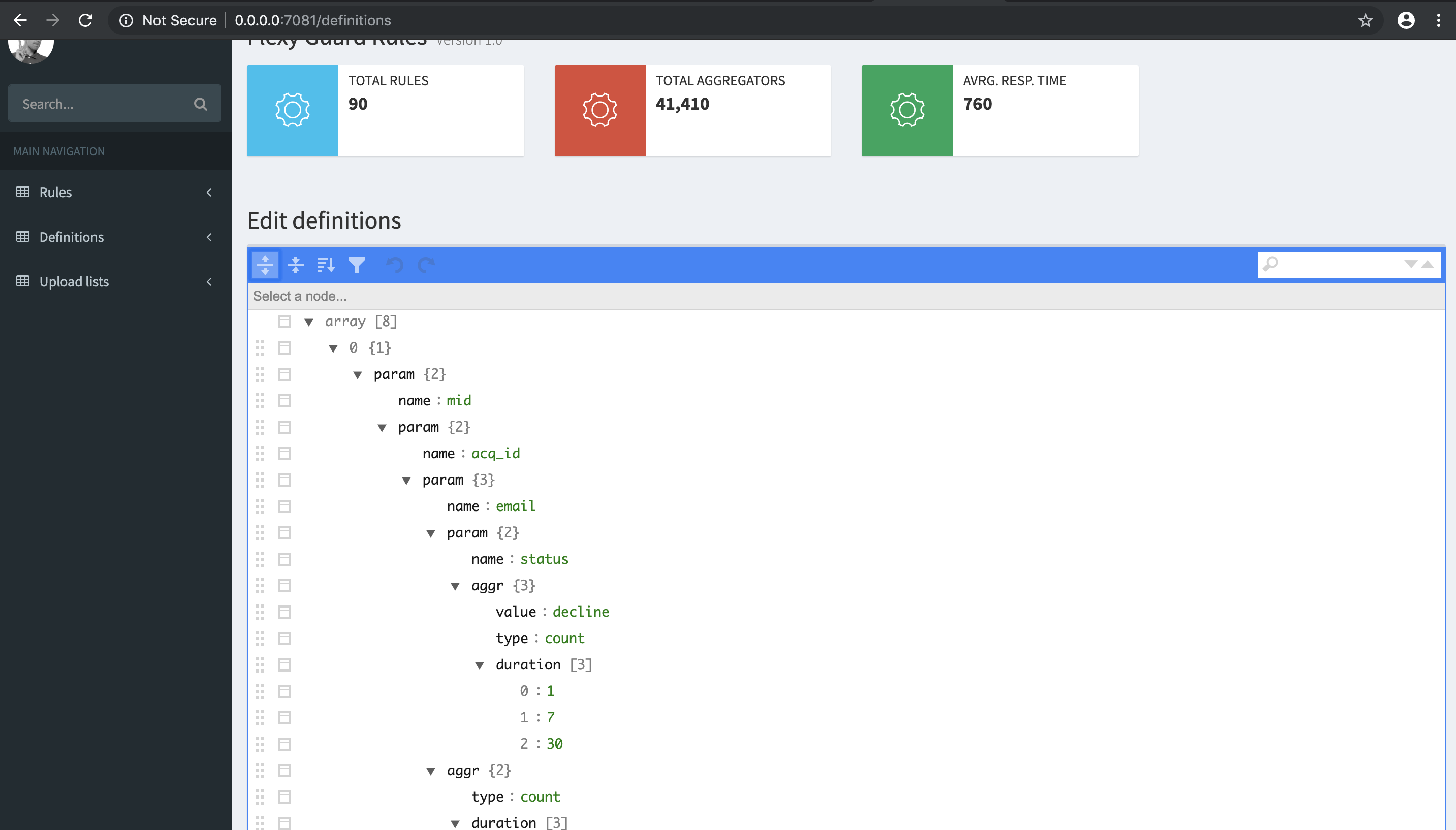

To implement filtering by a parameter aggregated value (periodic-wise) we have to define which parameters should be aggregated along with its dependencies from the other parameters

Example: we need to filter payments according to the accumulated 7 days turnover from a single card

To do so we need to add definition to FlexyCard and instruct it to start accumulating "amount" paramter values from a unique "card" paramter value and drop this value every 7 days for each card parameter value.

Also we want to do so for each unique mid, acq_id and currency parameters, in this case defintion must be as following:

[

{

//defining a new parameter to perform aggregation, "mid" wil be the first unique parameter

"param": {

"name": "mid",

//defining next unique nested parameter "acq_id"

"param": {

"name": "acq_id",

//another nested unique prameter "currency"

"param": {

"name" : "currency",

//defining card unique nested param

"param": {

"name": "card",

//aggregating amount and setting drop value period to 7 days

"param": {

"name": amount,

"aggr": {

"type": "sum",

"duration": [7]

}

}

}

}

}

}

}

]

The following definitions for aggregates are already predifined in the system and could be changed on FlexyGaurd admin console:

"mid>acq_id>email>count 1, 7, 30 days" - counts payment within mid, acq_id and single email "mid>ip>count 1, 7, 30 days" - counts payment from a single ip address within unique mid parameter

etc

'Full list of definitions could be checked on FlexyGuard admin console Definitions>Aggr section from the left menu, please note that definition are rarely to be modified only in the case of changing the rule (adding new param to the payment entity) schema or aggregation logic'

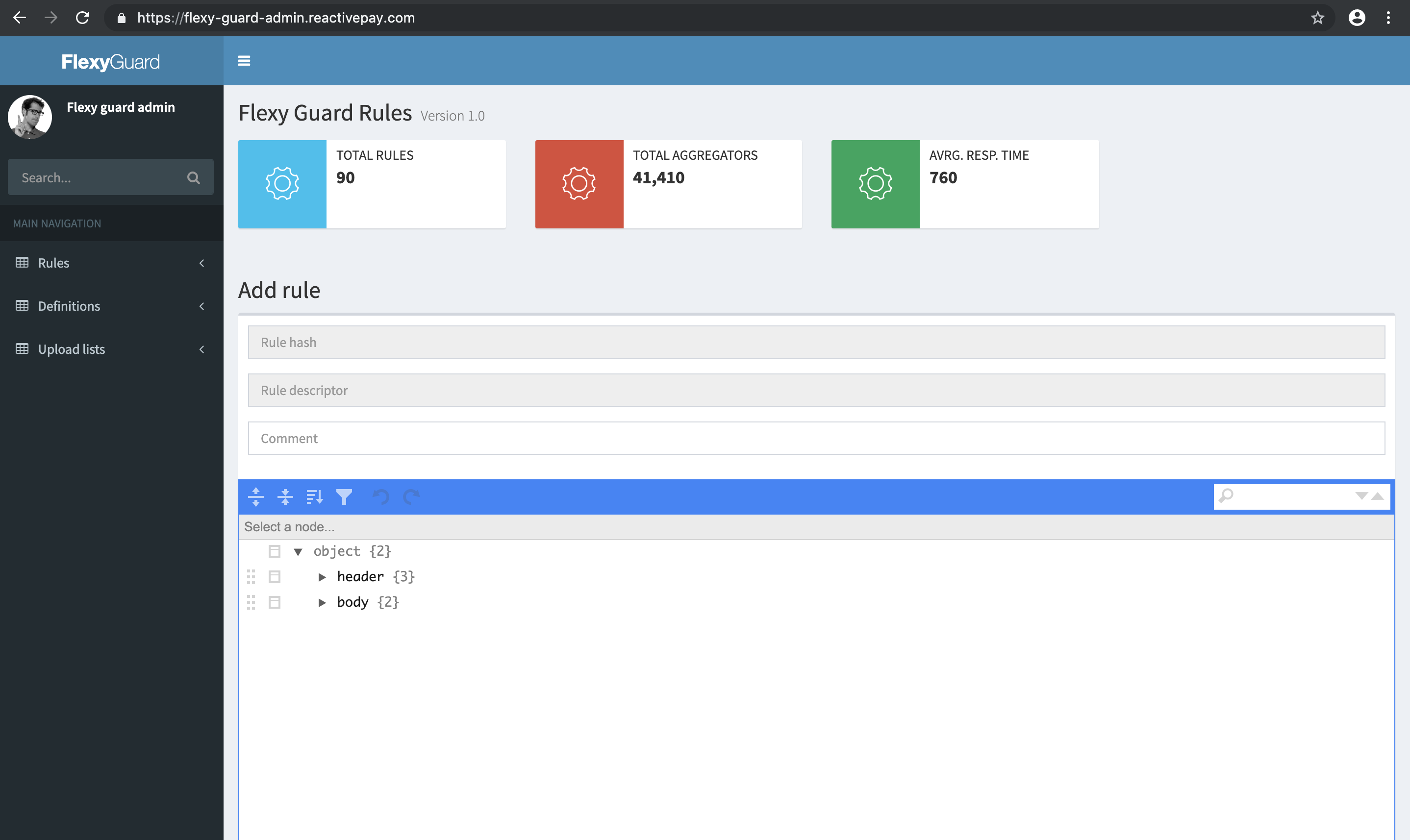

- Adding a new rule

To add a new rule please navigate to Add Rule page bu clicking FlexyGuard log at the upper left corner

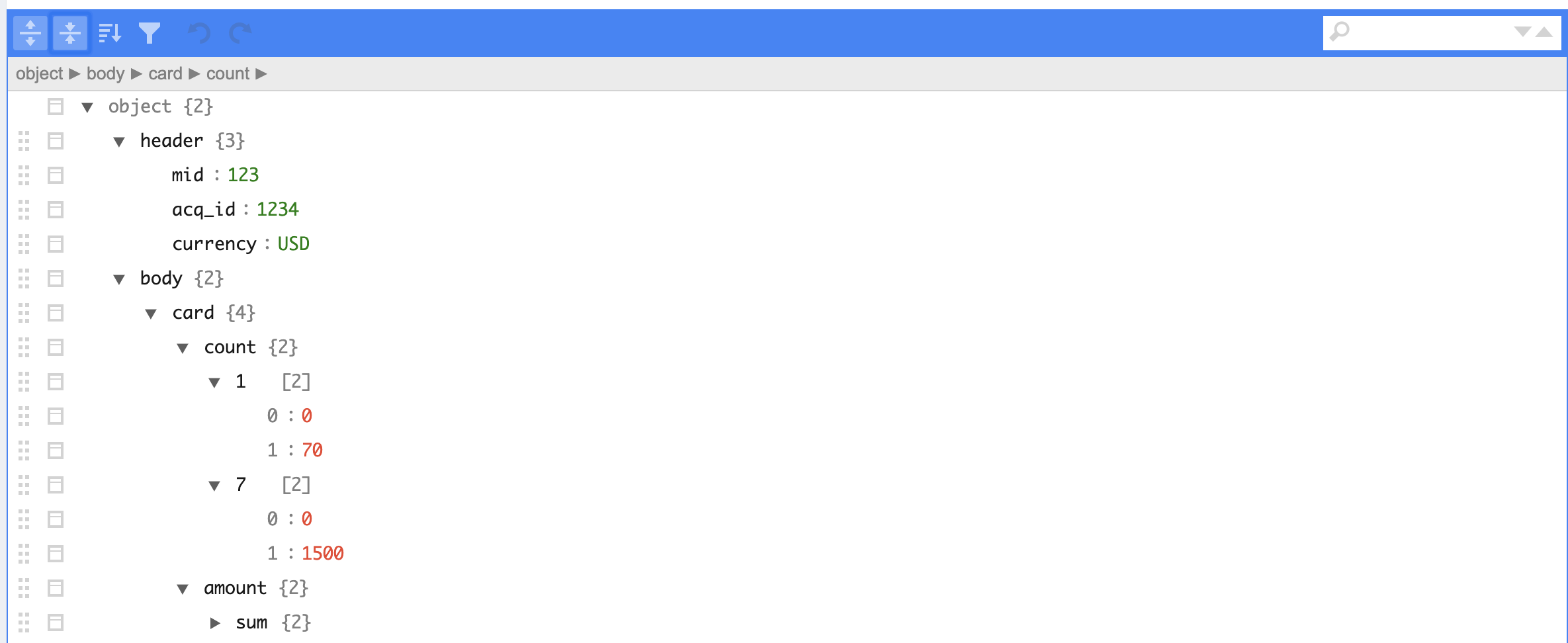

count - sets a range in which param presence in the payment request count must be checked

sets the range for payment count withing one card parameter within 1 and 7 days

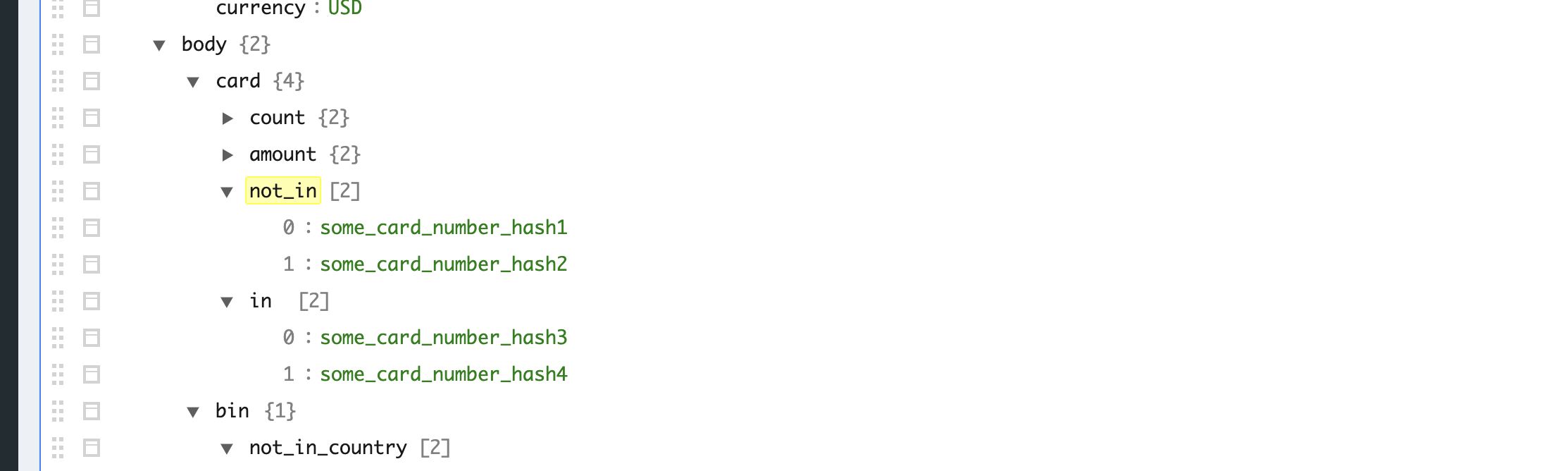

not_in/in - checks that parameter value is not in or in the list

sets a list of card parameter and checks if card value not in the list

not_in_country - checks if specific parameter value not in the country list associated with this parameter

in_country - checks if specific parameter value is in the country list associated with this parameter

checks if bin parameter value is not in the list

value - checks if parameter value is withing the range

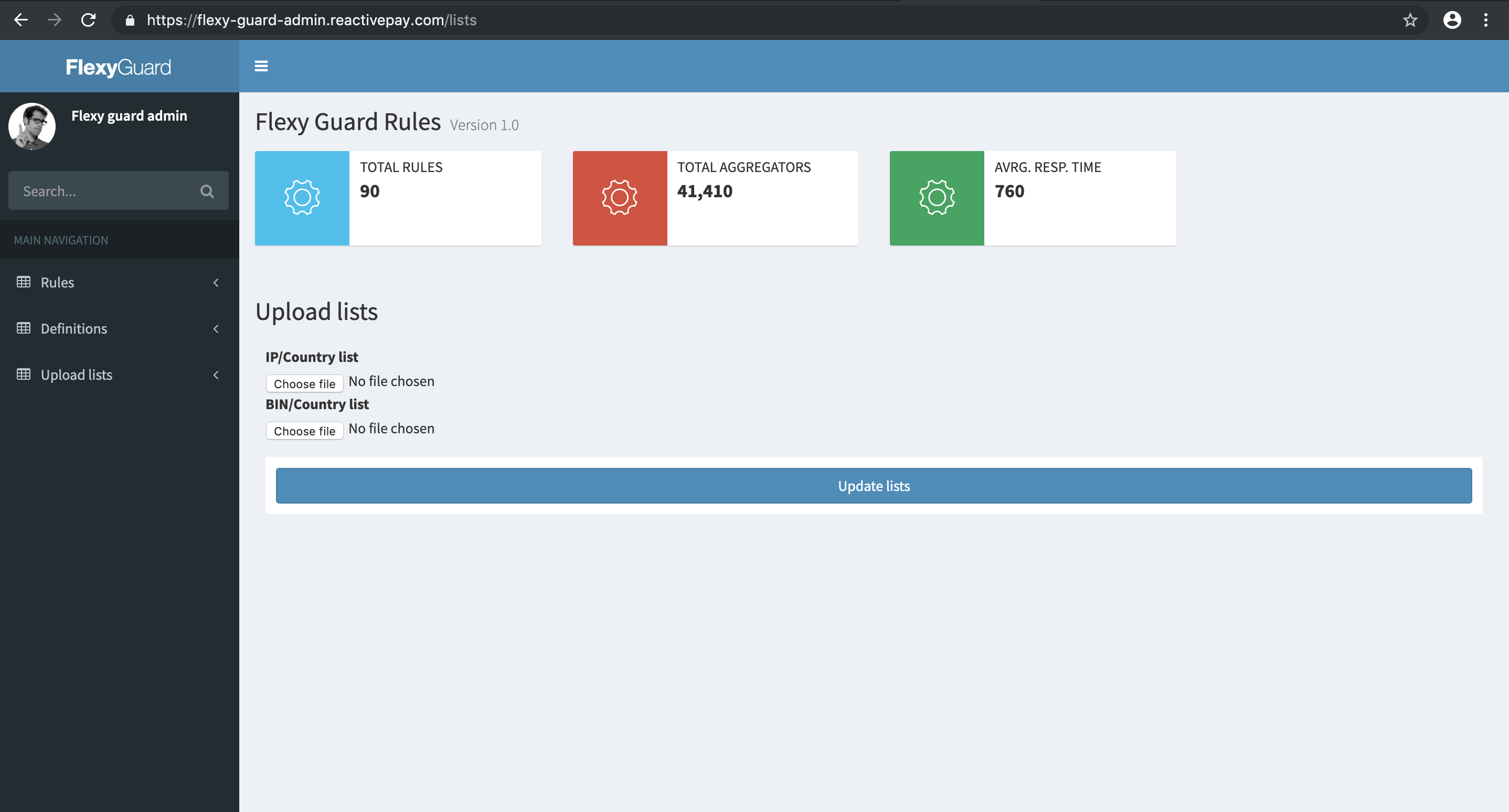

To update the parameter (bin, ip) country lists please navigate to the page above

Uploaded files should be a formatted CSV with headers at the firt row

BIN countries file format example:

bin;ps;bank_name;type;sub_type;country;ccode_short;ccode_iso;code;www 021502;PRIVATE LABEL;;DEBIT;;UNITED STATES;US;USA;840;;

IP address country file example:

IP1;IP2;IP1_int;IP2_int;code_short;code_iso;code_number;country_name 1.0.0.0;1.0.0.255;16777216;16777471;AU;AUS;036;AUSTRALIA

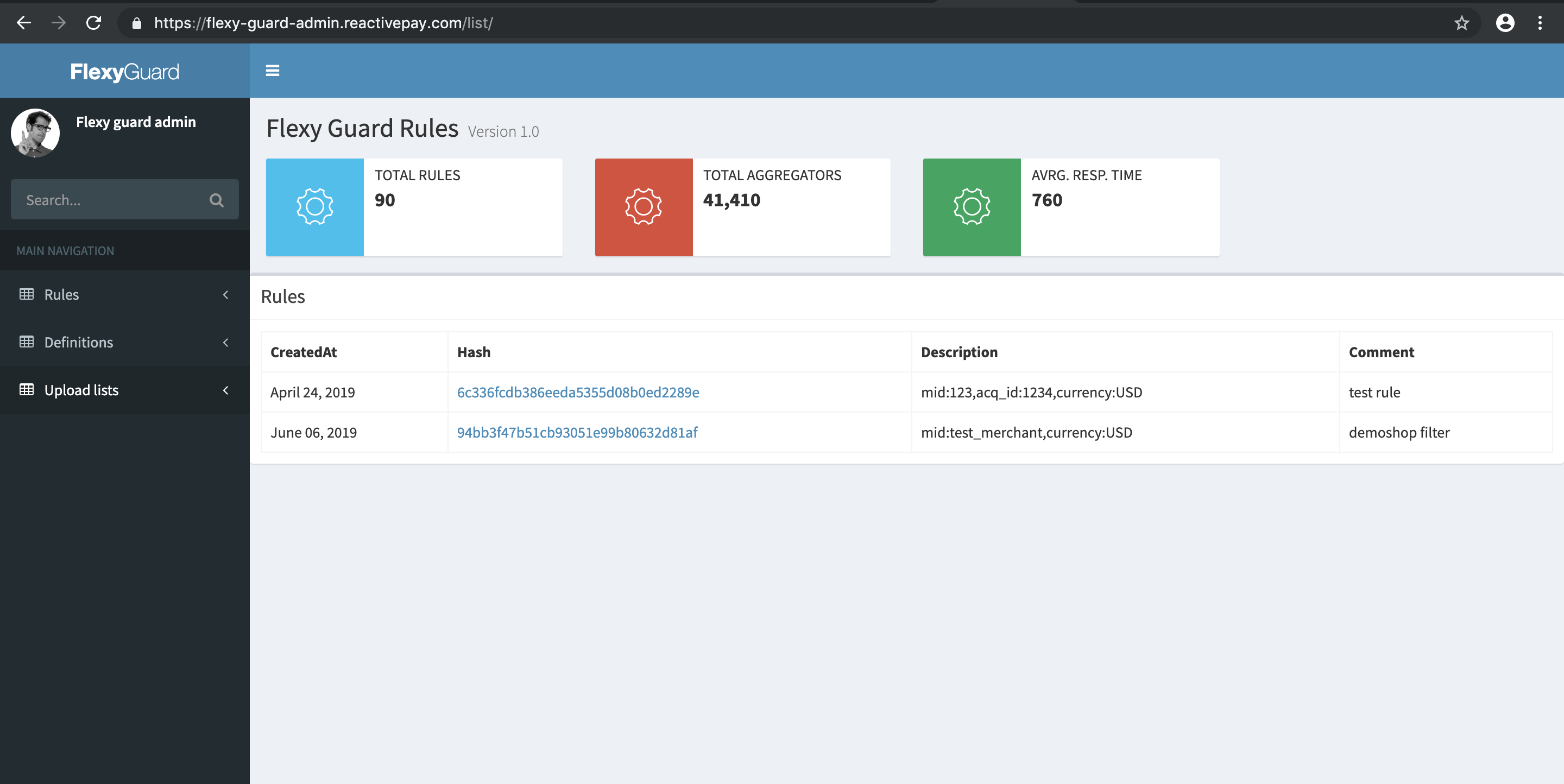

To search the rule please enter any text on the Search text box

To modify the rule just follow the link under rule hash value

When you save a rule the system automatically creates a hash value and descriptor based on header parameters

Please add comment whcih will be added to the search index along with hash and descriptor, please mind that proper naming in the comment fild will help to easily navigate the rule lists in the future, for example

Bank Of China

Bank Of China: High risk

Bank Of China: High risk: China Airlines

The first rule has only acq_id parameter at the header and defines the global rule for this bank_name The second one is for high risk merchant categories, like mcc parameter and acq_id posted on the header The last one for a specific merchant and has acq_id, mcc, mid parameters in the header

'The headers are unique within the systems, you can't create two rules with the same header value'