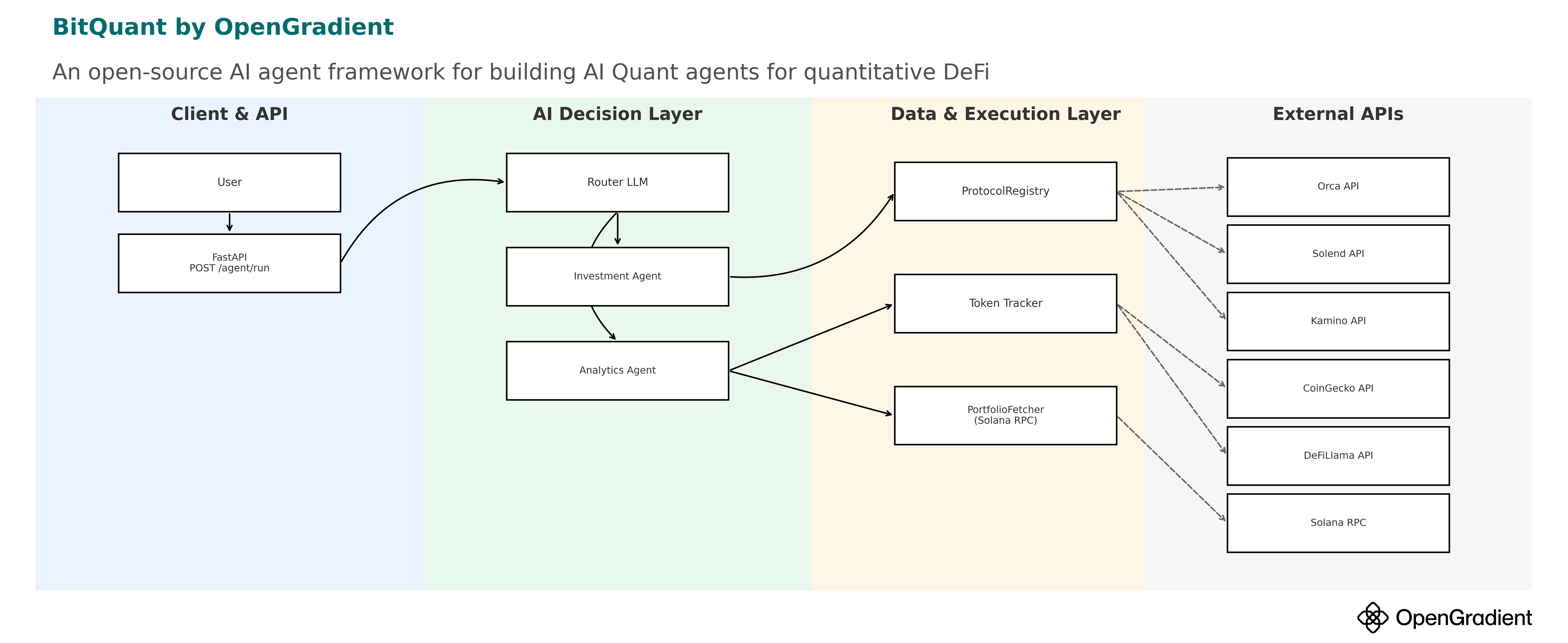

BitQuant is a open-source AI agent framework for building quantitative AI agents. It leverages specialized models for ML-powered analytics, trading, portfolio management, and more—all through a natural language interface. BitQuant exposes a REST API that turns user inputs like "What is the current risk profile on Bitcoin?" or "Optimize my portfolio for maximum risk-adjusted returns" into actionable insights.

- Features

- Architecture

- Installation

- Usage

- Configuration

- Integrations

- Testing

- Deployment

- Contributing

- License

- Contact

- 🤖 Build and deploy quantitative AI agents for analytics, trading, and portfolio management

- 🧠 Natural language interface for complex financial queries

- 🔌 Modular architecture with agent and tool plug-ins

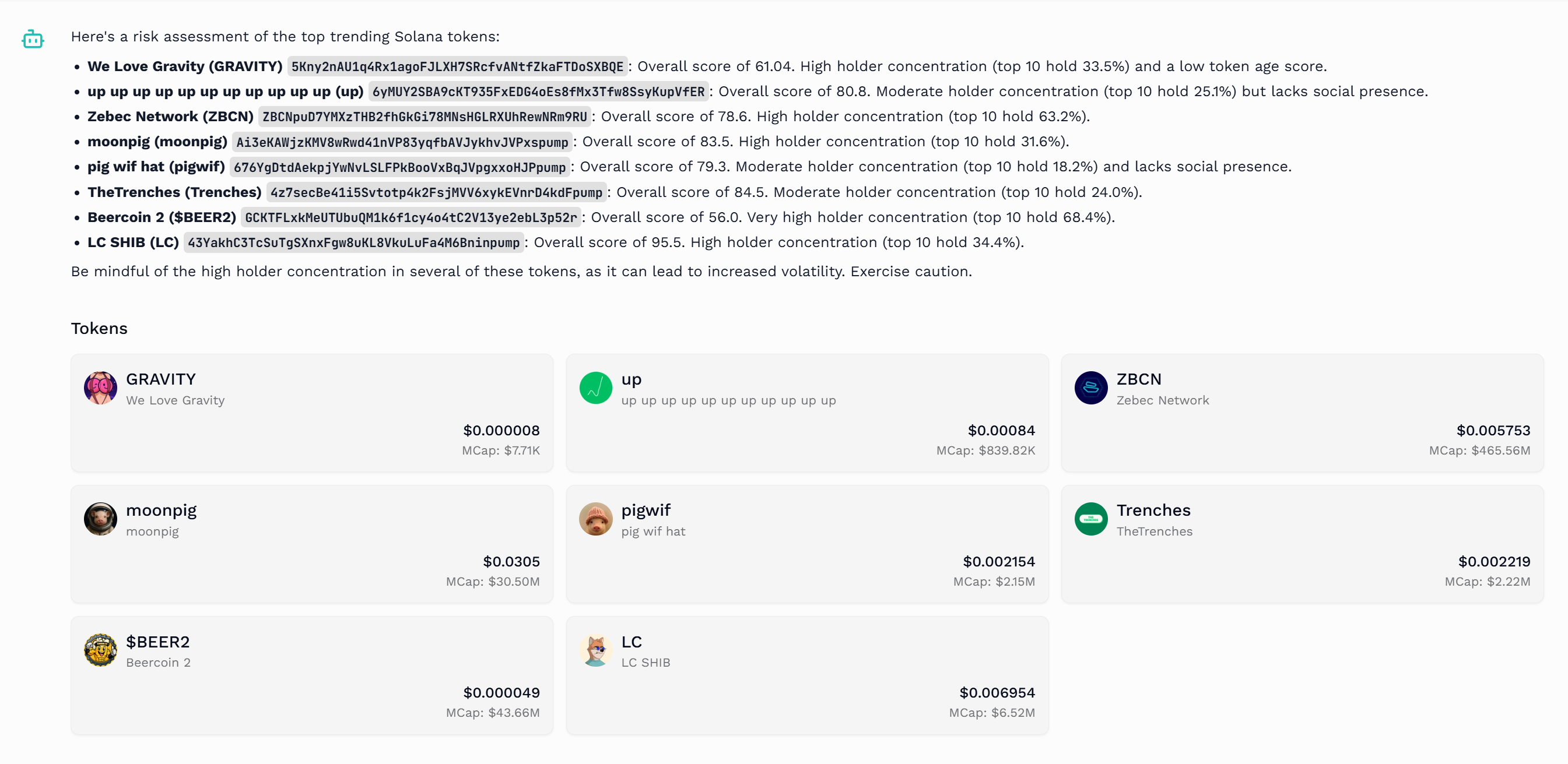

- 📈 Real-time crypto analytics and risk profiling

- 🌐 REST API for seamless integration

- ⚡ Fast setup and extensible codebase

agent/ # Agent logic and tool definitions

api/ # Server API input/output types

onchain/ # Classes for on-chain data (tokens, pools, etc.)

server/ # Flask server exposing the API

static/ # Static assets for web interface

subnet/ # Bittensor Subnet-related functionality

templates/ # LLM prompt templates for agent

testclient/ # Client for testing the API

testutils/ # Utility functions for testing

- Analytics Agent: Handles crypto analytics (price trends, risks, trending tokens, etc.)

- Investment Agent: Helps users select lending/AMM pools to maximize returns on Solana

The router in

server.pydecides which agent to use for each user query.

make venv

source venv/bin/activate

make installBefore running the service, you need to set up the following environment variables. Create a .env file in the root directory with the following variables:

Firebase Authentication:

FIREBASE_PROJECT_ID=your_firebase_project_id

FIREBASE_PRIVATE_KEY_ID=your_private_key_id

FIREBASE_PRIVATE_KEY="-----BEGIN PRIVATE KEY-----\nYour private key here\n-----END PRIVATE KEY-----"

FIREBASE_CLIENT_EMAIL=your_service_account_email

FIREBASE_CLIENT_ID=your_client_id

FIREBASE_CLIENT_X509_CERT_URL=your_cert_urlSolana RPC:

SOLANA_RPC_URL=your_solana_rpc_endpointAPI Keys:

OPENROUTER_API_KEY=your_openrouter_api_key

GEMINI_API_KEY=your_gemini_api_key

COINGECKO_API_KEY=your_coingecko_api_keyAWS (for DynamoDB):

AWS_ACCESS_KEY_ID=your_aws_access_key

AWS_SECRET_ACCESS_KEY=your_aws_secret_key

AWS_REGION=your_aws_regionDatadog Monitoring:

DD_API_KEY=your_datadog_api_key

DD_APP_KEY=your_datadog_app_key

DD_HOSTNAME=your_hostnameCloudflare Turnstile (for CAPTCHA):

CLOUDFLARE_TURNSTILE_SECRET_KEY=your_turnstile_secret_keyEnvironment:

ENVIRONMENT=development-

Create your

.envfile with the required variables:# Copy and edit the environment variables above -

Build the server:

make docker

-

Start the server:

make prod

You can also try BitQuant instantly on the production server.

Here are some example queries you can try with BitQuant:

- Which protocols are delivering the best risk-adjusted yields right now?

- What's my potential impermanent loss risk if I provide liquidity to the USDC-SOL pool under different market scenarios?

- Calculate a comprehensive risk score for the top 5 Solana DeFi protocols based on TVL trends, code audits, and historical performance

- Compare the TVL growth, volatility, and stability metrics for Kamino vs Orca vs Raydium

- Which lending protocols have maintained the most stable yields over the past 3 months?

- Can you analyze my portfolio's rolling volatility and identify which assets are contributing most to risk?

- How do the volatility trends of my top portfolio assets compare over the last 90 days?

- Show me the correlation between my holdings and provide insights on how to better diversify?

- What's my current portfolio risk assessment and how can I optimize for a better risk-return ratio?

- What's the maximum drawdown for my current portfolio and how does it compare to market benchmarks?

- Based on current volatility trends and price patterns, what phase of the market cycle are we likely in?

- Based on historical data, what's the volatility forecast for BTC and ETH in the coming month?

BitQuant is designed to support a wide range of quantitative and DeFi-focused AI agents. Out of the box, the framework includes:

- Purpose: Provides deep analytics on portfolios, tokens, protocols, and market trends.

- Capabilities:

- Analyze portfolio volatility, drawdowns, and diversification

- Evaluate token and protocol risks

- Track TVL, yield, and performance metrics

- Identify trends and generate actionable market insights

- Example Use Cases:

- "Analyze my portfolio’s risk profile."

- "Show TVL trends for Solana DeFi protocols."

- Purpose: Helps users find and act on yield opportunities and optimize DeFi strategies.

- Capabilities:

- Recommend optimal pools and lending opportunities

- Compare APRs, TVL, and risk across protocols

- Guide users through liquidity provision, lending, and yield farming

- Example Use Cases:

- "Which pools offer the best stablecoin yields?"

- "Compare Kamino and Orca for USDC/SOL."

- Purpose: The framework is extensible—developers can build agents for:

- Automated trading strategies

- On-chain data monitoring and alerting

- NFT analytics

- Cross-chain portfolio management

- Any custom DeFi or analytics workflow

Tip: Agents are modular and can be combined, routed, or extended to suit your specific use case. See the

agent/directory and templates for examples and customization.

- All configuration is handled via the

.envfile, which you can generate from.env.example. - Fill in all required secrets and keys as described in

.env.example.

- REST API: Exposes endpoints for agent interaction

- Bittensor Subnet: For decentralized compute

- Custom LLM Prompts: In

templates/

To run all tests:

make testBuild and run in production:

make docker

make prodContributions are welcome! Please open issues or pull requests for features, bugs, or documentation improvements.

- Fork the repo

- Create your feature branch (

git checkout -b feature/AmazingFeature) - Commit your changes (

git commit -m 'Add some AmazingFeature') - Push to the branch (

git push origin feature/AmazingFeature) - Open a Pull Request

This project is licensed under the MIT License. See the LICENSE file for details.

- Powered by OpenGradient

- Try Bitquant at bitquant.io

- OpenGradient Documentation: OpenGradient Docs

- Join the discussion: GitHub Discussions

- Support: BitQuant Discord

Empowering next-gen quantitative AI agents with OpenGradient.