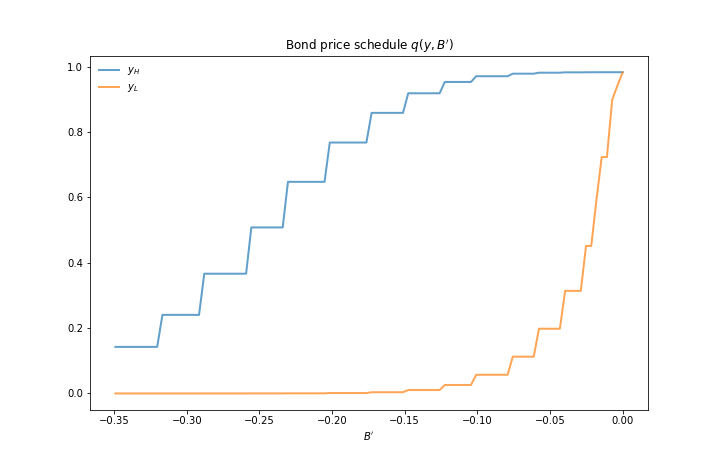

@@ -709,8 +709,8 @@ The first figure shows the bond price schedule and replicates Figure 3 of

709709Arellano, where $ y_L $ and $ Y_H $ are particular below average and above average

710710values of output $ y $.

711711

712-

713-

712+ ```{figure} _static/lecture_specific/arellano/arellano_bond_prices.png

713+ ```

714714

715715- $ y_L $ is 5% below the mean of the $ y $ grid values

716716- $ y_H $ is 5% above the mean of the $ y $ grid values

@@ -729,16 +729,17 @@ The figure shows that

729729

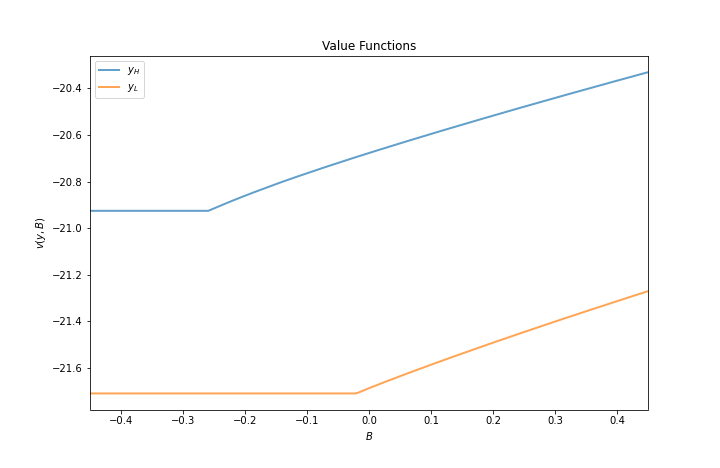

730730The next figure plots value functions and replicates the right hand panel of Figure 4 of {cite}`Are08`.

731731

732-

732+ ```{figure} _static/lecture_specific/arellano/arellano_value_funcs.png

733+ ```

733734

734735

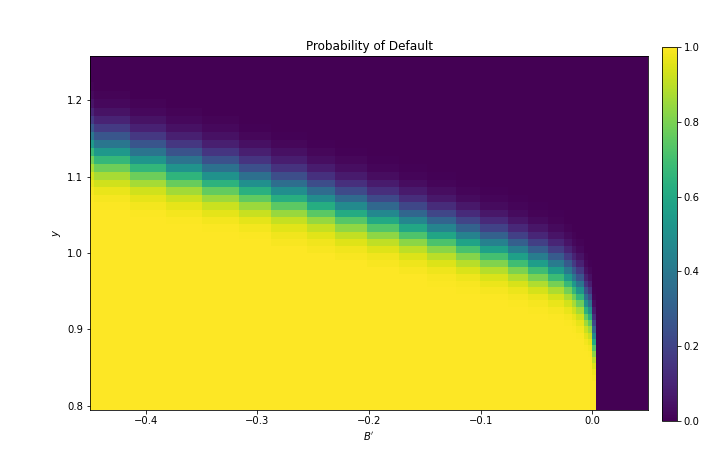

735736We can use the results of the computation to study the default probability $ \delta(B', y) $

736737defined in {eq}`equation13_4`.

737738

738739The next plot shows these default probabilities over $ (B', y) $ as a heat map.

739740

740-

741-

741+ ```{figure} _static/lecture_specific/arellano/arellano_default_probs.png

742+ ```

742743

743744As anticipated, the probability that the government chooses to default in the following period

744745increases with indebtedness and falls with income.

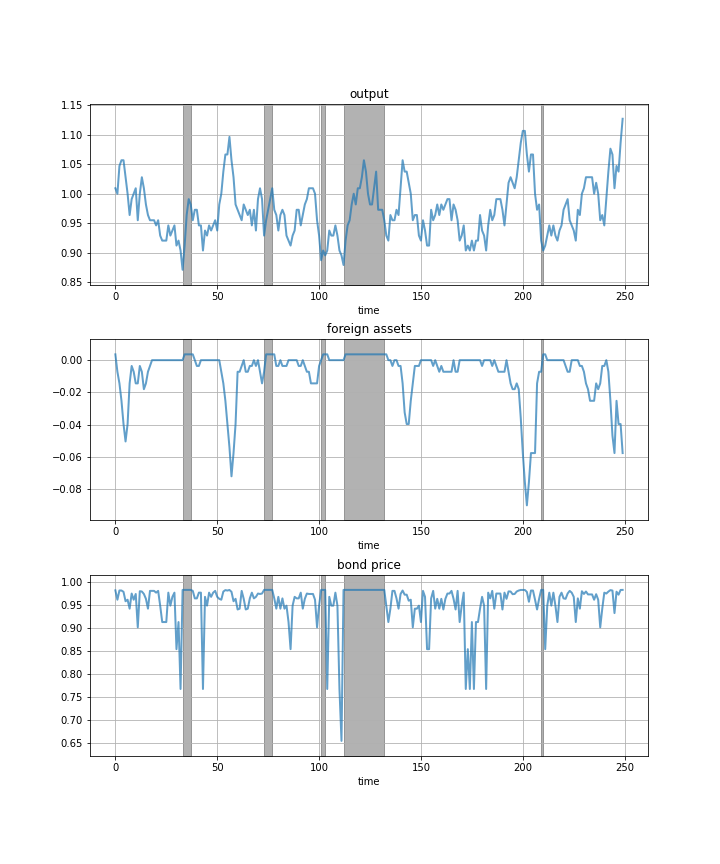

@@ -747,19 +748,15 @@ Next let’s run a time series simulation of $ \{y_t\} $, $ \{B_t\} $ and $ q(B_

747748

748749The grey vertical bars correspond to periods when the economy is excluded from financial markets because of a past default.

749750

750-

751-

751+ ```{figure} _static/lecture_specific/arellano/arellano_time_series.png

752+ ```

752753

753754One notable feature of the simulated data is the nonlinear response of interest rates.

754755

755756Periods of relative stability are followed by sharp spikes in the discount rate on government debt.

756757

757- +++

758-

759758## Exercises

760759

761- +++

762-

763760```{exercise-start}

764761:label: arellano_ex1

765762```

@@ -772,14 +769,10 @@ To the extent that you can, replicate the figures shown above

772769```{exercise-end}

773770```

774771

775- +++

776-

777772```{solution-start} arellano_ex1

778773:class: dropdown

779774```

780775

781- Solution to this [exercise](https://python-advanced.quantecon.org/arellano.html#arella_ex1).

782-

783776Compute the value function, policy and equilibrium prices

784777

785778```{code-cell} ipython3

0 commit comments