A low-risk, fun, and easy-to-use prediction market with social interaction.

- GitHub Repository

- Deck

- Pitch Video:

- Product Video:

- Online Demo Link

- Pro version(the same UI as PolyMarket): https://pro.Pred.WTF

- Mobile first version: https://Pred.WTF

- Offchain version: https://Pred.WTF/t-1 (replace t-1 to t-2,3...17)

- Contract Deployment Information

- Contract Address: 0x323843963e5ea78152742e5595edc6929b150230

- Blockchain: Binance Smart Chain

- Explorer: https://bscscan.com/address/0x323843963e5ea78152742e5595edc6929b150230

Click to expand the details

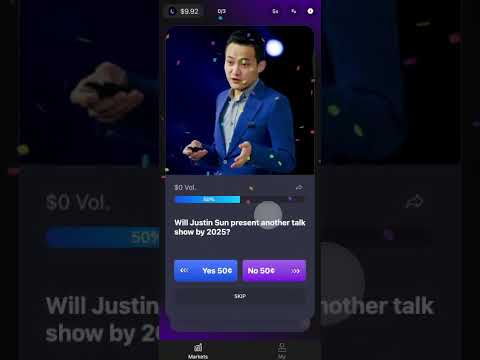

Click the image above to watch the Welcome Screen video

Click the image above to watch the Swipe to trade Screen video

- Key Modules:

- Frontend: Swipe trading system/Embedded wallet/Cross-chain transfer integration

- Backend: Off-chain order matching/Hybrid decentralized exchange model

- Contracts: Cross-chain bridge technology/Efficient transaction settlement/Decentralized security/Ecosystem compatibility

- Dependencies & Tech Stack:

- Frontend: Vue/Nuxt.js, Viem.sh, Wagmi.sh, Tailwind CSS, Privy.js

- Backend: Node.js, Supabase, PostgreSQL

- Contracts: Solidity, EIP2535, OpenZeppelin, ERC1155, ERC20

- Deployment: Vercel, AWS

Click to expand the details

A- ERC1155 outcome tokenA'- ERC1155 complementary outcome token*C- ERC20 collateral token- All examples assume

AandA'are priced at 0.5 USDC each

*Note: Complementary relationship means 1 outcome token + 1 complementary token can be merged into 1 collateral token, and vice versa (i.e., A + A' = C). Assume outcome tokens and collateral tokens have the same decimal precision. Examples assume C is USDC.

- user1 buys 100

A, transfers 50Cto exchange - user2 buys 100

A', transfers 50Cto exchange - Exchange mints 100

Afor user1, 100A'for user2

const takerOrder = {

salt: randomId(),

maker: user1,

tokenId: 1, // Token ID for A'

tokenAmount: 100 * 10**6,

tokenPriceInPaymentToken: 0.5 * 10**6, // 0.5 USDC (could be 0 for market orders)

paymentTokenAddress: '0xxxxx', // USDC address

slippageBps: 100, // Allowed slippage (0 indicates limit order)

deadline: 1672531200, // Expiration timestamp

side: 1, // 1: buy, 2: sell

feeTokenAddress: '', // Fee token address (USDC or company token)

// Signature fields

sig: 'xxxxx', // Frontend signature of above data

// Off-chain calculated transaction details

exchangeNftAmount: 100 * 10**6, // NFT amount maker will receive

paymentTokenAmount: 100 * 10**6, // USDC amount maker must pay

paymentTokenAddress: '0xxxxx', // Payment token address (USDC)

// Dual fee fields for multi-token fee support

fee1Amount: 123, // Primary fee amount

fee1TokenAddress: '0xxxxx', // Primary fee token (USDC/company token)

fee2Amount: 456, // Secondary fee amount

fee2TokenAddress: '0xxxxx' // Secondary fee token (USDC/company token)

}

const makerOrders = [{

salt: randomId(),

maker: user2,

tokenId: 2, // Token ID for A'

tokenAmount: 100 * 10**6,

tokenPriceInPaymentToken: 0.5 * 10**6,

paymentTokenAddress: '0xxxxx',

slippageBps: 100,

deadline: 1672531200,

side: 1,

feeTokenAddress: '',

sig: 'xxxxx',

exchangeNftAmount: 100 * 10**6,

paymentTokenAmount: 100 * 10**6,

paymentTokenAddress: '0xxxxx',

fee1Amount: 123,

fee1TokenAddress: '0xxxxx',

fee2Amount: 456,

fee2TokenAddress: '0xxxxx'

}]

matchOrders(takerOrder, makerOrders)- user1 buys 100

A, transfers 50Cto exchange - user2 sells 100

A, receives 50Cfrom exchange

- user1 sells 100

A - user2 sells 100

A' - Exchange merges 100

A+ 100A'into 100C - Exchange transfers 50

Cto user1 - Exchange transfers 50

Cto user2

Fees are collected from output assets (proceeds). For complementary binary tokens (A + A' = C), fees must maintain symmetry to preserve market integrity. Symmetry means selling 100 A at $0.99 and buying 100 A' at $0.01 should incur equal fee value.

Rules:

- Buy operations (receiving

A/A') charge fees on output tokens - Sell operations (receiving

C) charge fees on collateral tokens

Base fee rate (baseFeeRate) is written into order structure, corresponding to 2x fee rate when tokens are equally priced ($0.50/$0.50). Price deviations use formula:

USDC fee = baseFeeRate * min(price, 1-price) * token quantity

Example 1:

- price = 0.2

- feeBps = 100

- fee = 0.01 * min(0.2, 0.8) * 100 = 0.2

Example 2:

- Selling 100

Aat $0.99:

0.01 * min(0.99, 0.01) * 100 = 0.01 (deduct 0.01Cas fee) - Buying 100

A'at $0.01:

0.01 * min(0.01, 0.99) * 100 = 0.01 (deduct 1A'as fee)

- 1-3 Weeks Post-Competition: Complete continuous optimization of pages and system performance, improve user experience and market stability.

- 1-3 Months Post-Competition: Drive user growth through cold-start operations and community incentive programs; Conduct multiple marketing campaigns to enhance brand exposure and prediction market liquidity; Gradually launch Pre-Seed financing plan to provide funding support for subsequent product expansion and ecosystem construction.

Our team brings extensive expertise in both Web2 and Web3 technologies, with 20+ global hackathon awards and successful product scaling experience. We combine deep technical knowledge in blockchain development, frontend engineering, and AI tools with strong entrepreneurial backgrounds from major tech companies including 360, RC, iHealth.

Click to expand the details

Adam Ma – Founder & CEO

- Background: 15+ years in tech entrepreneurship with extensive Web2 and Web3 experience

- Web2 Experience: 360, iHealth , Sneaker Exchange platform (sneaker marketplace with millions in transaction volume)

- Web3 Expertise: Won 20+ global hackathon awards

- Current Focus: All-in on prediction markets since 2025, leading technical vision and product strategy

Alfred Fu – Co-founder & CMO

- Education: HKUST graduate with strong technical and creative background

- Experience: Years at Tsinghua Research Institute, deep expertise in AI tools and product ideation

- Role: Leads product design, social media strategy, and brand development

- Skills: Combines technical development experience with creative marketing insights

- 3 Full-Stack Core Developers: Experienced team covering backend, frontend, and smart contract development

- Total Team Size: 5 members (2 founders + 3 developers) with plans to expand

- Balanced Expertise: Technical depth combined with creative vision and business acumen

- Web3 Experience: Extensive blockchain and prediction market knowledge

- APAC Focus: Native understanding of Asian markets and cultural nuances

- Execution Track Record: Successfully launched functional MVP with real users