Institutional Margin Call Protection on Uniswap v4

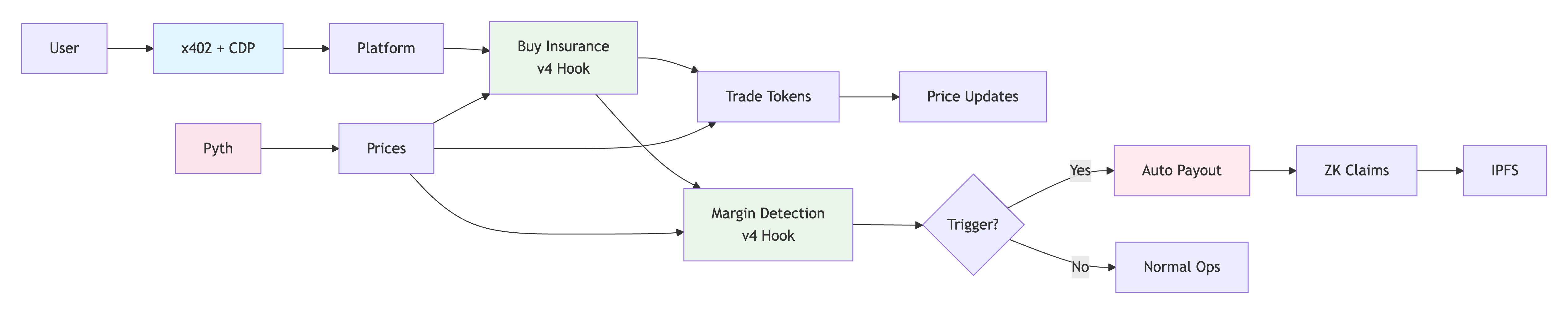

Antidote is the first fully permissioned margin call protection protocol built directly into Uniswap v4 hooks, providing institutional-grade risk management with regulatory compliance.

- Real-time margin call detection within Uniswap v4 hooks

- Automatic payouts when positions fall below 110% collateralization

- Live deployment on Ethereum Sepolia & Base Sepolia testnets

- KYC-gated access via Coinbase x402 & CDP Facilitator

- Permissioned secondary markets for risk token trading

- Compliant infrastructure for institutional participation

- ETH/USDC stable pool foundation for institutional risk markets

- Hermes pull architecture with on-chain price updates

- Dual update strategy: Fresh prices during purchases AND margin calls

- Real-time price consumption for premium calculations & risk assessment

- Automated price pusher with 30-second refresh intervals

- zk-SNARK claims with Poseidon hashing

- IPFS proof storage with decentralized archiving

- Local fallback storage for maximum reliability

- Fractional insurance shares in permissioned secondary markets

- Verified transaction history with real payout examples

- Automated coverage scaling based on position size

- Live system monitoring with real-time event feeds

- Position status tracking with color-coded risk levels

- Insurance pool management with automated funding alerts

- Uniswap v4 hook integration with atomic margin protection

- Pyth oracle integration with real-time price feeds

- ETH/USDC insurance pool implementation

- Institutional access controls via Coinbase x402

- Dynamic premium optimization based on market volatility

- Expanded asset coverage for major DeFi collateral types

- Cross-chain protection layers across multiple L2s

- Institutional lending protocols

- DeFi hedge funds

- Market makers & liquidity providers

- Treasury management

- Smart Contracts: Solidity, Uniswap v4, Pyth EVM SDK

- Frontend: Next.js, React, Wagmi, TailwindCSS

- Access Payments & Wallet verification: Coinbase x402, CDP Facilitator

- Oracles: Pyth Network (Hermes pull architecture)

- Deployment: Foundry, Vercel

- Connect Wallet → Any Ethereum/Base wallet

- Pay Access Fee → 1 USDC via Coinbase x402

- Get Protection → Deposit into Uniswap v4 pools

- Auto-Coverage → Margin calls trigger instant payouts

- Payment: Base Sepolia (x402 compliance verification)

- Platform: Ethereum Sepolia (insurance operations)

- Node.js 18+

- Coinbase Developer Platform account

- Alchemy account

Create a .env.local file with the following variables:

# x402 Seller Wallet (you generate this)

X402_SELLER_PRIVATE_KEY=yourx402sellerprivatekey

NEXT_PUBLIC_X402_SELLER_ADDRESS=youraddress

NEXT_PUBLIC_ACCESS_FEE_USDC=1

NEXT_PUBLIC_USDC_ADDRESS=0x036CbD53842c5426634e7929541eC2318f3dCF7e

# Payment Network (Base Sepolia)

NEXT_PUBLIC_PAYMENT_CHAIN_ID=84532

NEXT_PUBLIC_PAYMENT_NETWORK=base-sepolia

# Platform Network (Ethereum Sepolia)

NEXT_PUBLIC_PLATFORM_CHAIN_ID=11155111

NEXT_PUBLIC_PLATFORM_NETWORK=ethereum-sepolia

# Poseidon Addresses (for ZK proofs)

NEXT_PUBLIC_POSEIDON_T3=0x3333333C0A88F9BE4fd23ed0536F9B6c427e3B93

NEXT_PUBLIC_POSEIDON_T4=0x4443338EF595F44e0121df4C21102677B142ECF0

NEXT_PUBLIC_POSEIDON_T5=0x555333f3f677Ca3930Bf7c56ffc75144c51D9767

NEXT_PUBLIC_POSEIDON_T6=0x666333F371685334CdD69bdDdaFBABc87CE7c7Db

# Private environment variables (server-side only)

CDP_API_KEY_ID=yourkey

CDP_API_KEY_SECRET=yoursecret

PRIVATE_KEY=yourwalletprivatekey

# Alchemy RPC URLs

ALCHEMY_BASE_SEPOLIA_URL=https://base-sepolia.g.alchemy.com/v2/your-key

ALCHEMY_ETHEREUM_SEPOLIA_URL=https://eth-sepolia.g.alchemy.com/v2/your-key